Transparent, unbiased, hassle-free.

Platforms that appear cheap charge you thousands in hidden costs and commissions, it's hard to know who to trust when it comes to investing, and none of this is easy to figure out. We built Orowealth to fill this need.

Time tested strategies.

We distribute your wealth across 6 asset classes, so you face lower risks and get better returns.

What is the best way to distribute your wealth? We base that on your risk profile, so your portfolio is customised for you.

We regularly review and rebalance your portolio to maintain its quality and keep up its performance.

Rock solid performance.

Our portfolios consistently outperform their competitors. Over the past two years, Orowealth has helped investors make up to 5% extra returns on their investments.

Aggressive investors

19.70% returns

Balanced investors

15.40% returns

Conservative investors

7.90% returns

Backed by seasoned investors.

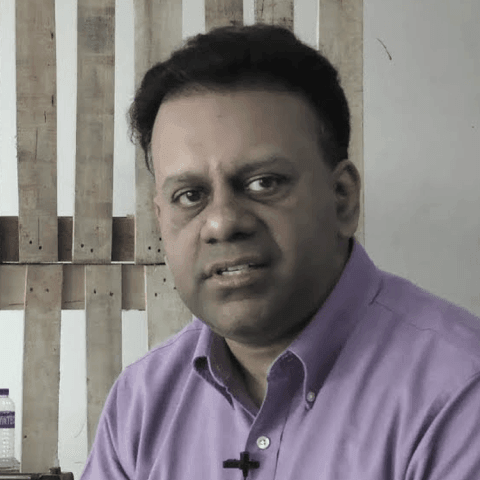

Sri Peddu

Founder and Managing Director,

Powerhouse Ventures

Hiro Mashita

Founder and Director,

M&S Partners Pte. Ltd.

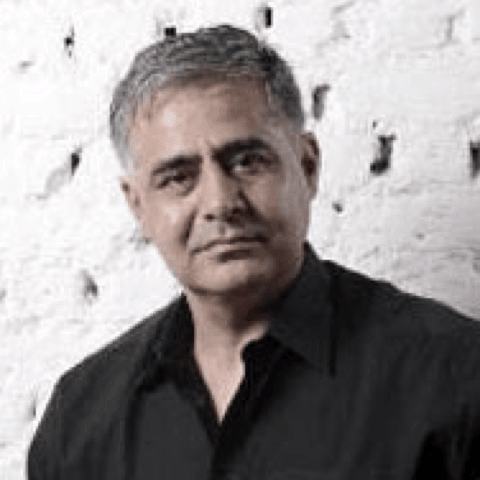

Rajesh Sawhney

Co Founder at InnerChef,

Founder of GSF Accelerator

B-Dash Ventures

Money Forward

Social Capital

BANK GRADE SECURITY

Your security is our biggest priority. We use state-of-the-art security measures to make sure your financial data stays safe.

PROVEN PERFORMANCE

Our portfolios are designed to give you the best returns for every risk level, and consistently outperform their peers.

TIME TESTED STRATEGIES

Our investment strategies are based on three proven principles — diversification, strategic asset allocation, and periodic rebalancing.