Types of Loans In India

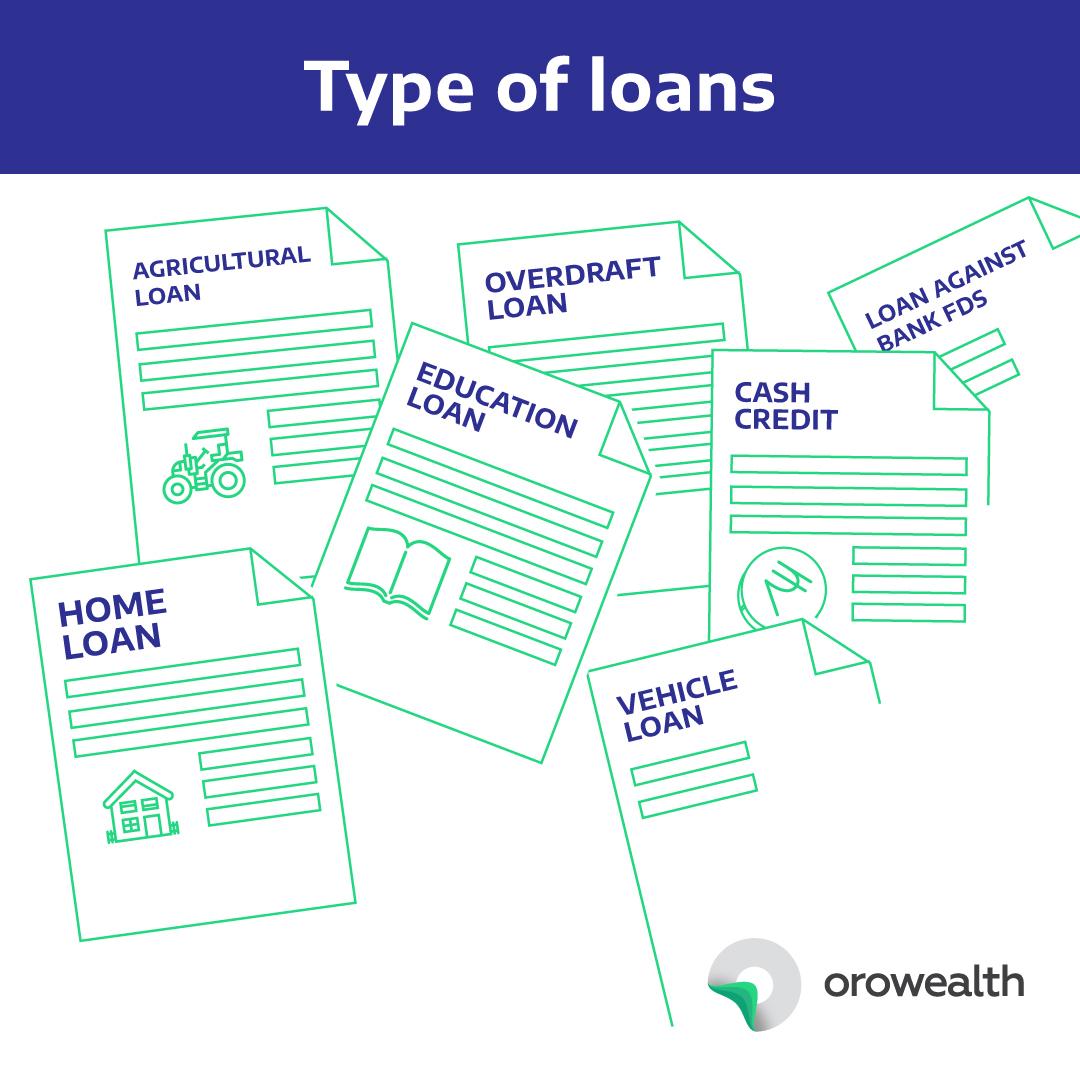

Type of Loans Available in India

There are numerous types of loans available in India. However, most people choose a personal loan over other types in spite of having a variety of assets, which they can mortgage to avail loans at a lower interest rate. One of the reasons behind this scenario is the lack of knowledge about different types of loans available in India.

By definition, a loan is a specified amount of money that you can borrow from the lender (usually banks) with an assurance of returning it back within the agreed period. The lender on different types of loans levies a specified rate of interest. The borrower repays the borrowed amount along with the interest in installments as per the agreement between the two parties.

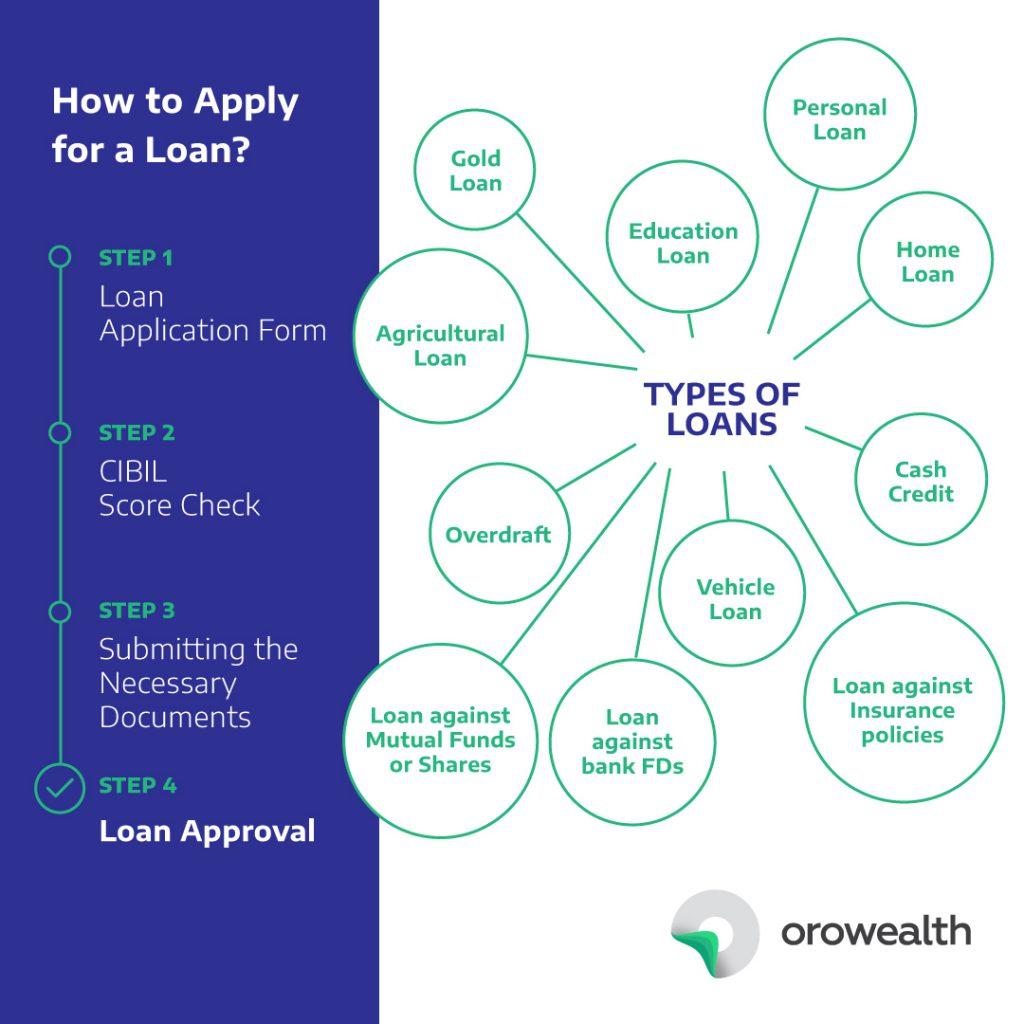

How to Apply for a Loan?

Contrasting to the general myth, applying for a loan is not a complicated process. You should be particularly careful about the fact that you provide banks with all the genuine documents. In India, different types of loans need a different set of documents.

Steps for Applying for Loan

- Loan Application Form: You need to fill up the application form for the type of loan you need from the bank. You need to make sure that all the information written on the form is genuine and correct.

- CIBIL Score Check: The bank then checks up your CIBIL to count the score of your credit cards. CIBIL tracks and maintains the records about the money/loans you need to repay apart from the current loan you are trying to apply. If you have a high credit score, your loan application is easily approved.

- Submitting the Necessary Documents: The borrower needs to produce a series of documents to supplement their loan application form. Documents such as proof of identity, income proof, and other certificates need to be submitted along with the application form.

- Loan Approval: Once you submit the application form along with all the necessary documents, the bank verifies all the details you have provided. Once the verification is complete and the results are satisfactory the bank approves your loan application.

Types of Loans in India

Different Types of Loans in India

Let’s look at some of the common types of loan available in India:

Personal Loan:

Personal loans are provided to meet the personal needs of the borrower. You can use the money from this type of loan in any way you see fit. You can pay off your previous debts, buy some expensive accessories for yourself, and plan a great trip with your family. It’s up to you how to use the money. The interest rates for this type of loan are on the higher side compared to the other types of loans.

Home Loan:

Everybody dreams of owning their own house. However, buying a house needs a lot of money and it is not always possible to have that much money at once. Banks now offer home loans that can assist you in purchasing a property. A home loan can be of different types such as:

- Loan for constructing a house

- Loan for repairing and remodelling your existing home

- Loan for purchasing a land

Education Loan:

Banks also offer education loans to the ones who need it. These loans offer a better support in terms of study opportunities to students are financially weak. Students looking to pursue higher education can avail education loan from any bank in India. Once they secure a job, they need to repay the money from their payment.

Gold Loan:

Among all the types of loans available in India, the fastest and easiest one to get is the gold loan. This type of loan was very popular back in the days when the rates of gold were rising exponentially. Gold companies are facing losses due to falling rates of gold in the recent times.

Vehicle Loan:

Vehicle loans help you fulfil your dream of owning a car or bike. Almost all banks provide this type of loan. It a secured loan means if the borrower doesn’t pay the instalments in time, the bank has the right to take back the vehicle.

Agricultural Loan:

There are multiple loan schemes by banks to assist farmers and their needs. Such loans have very low interest rates and help farmers to buy seeds, equipment for farming, tractors, insecticides etc. to generate a better yield. The repayment of the loan can be made after the yielding and selling of crops.

Overdraft:

Overdraft is a process of requesting loans from banks. It means that the customers can withdraw more money than they have deposited in their accounts.

Loan against Insurance policies:

If you have an insurance policy, you can apply for a loan against it. Only those insurance policies that are aged over 3 years are eligible for such loans. The insurer can themselves offer a loan amount on your insurance policy. Approaching the bank for the same is optional. You need to submit all the documents related to the insurance policy to the bank.

Cash Credit:

Cash credit is a bank procedure of paying a customer in advance. This process permits the customer to borrow a certain amount from the bank. The customer provides a few securities to the bank in exchange for cash credit. The customer can renew this process each year.

Loan against bank FDs:

If you have a fixed deposit in with a bank, you can apply for a loan against the same. If the FD is around or more INR 100,000, you can apply for a loan of INR 80,000. The rate of interest levied on such loan is comparatively higher than that paid by the bank on your FD.

Loan against Mutual Funds or Shares:

Generally, people offer their mutual fund investment or shares as a collateral for their loan application. The banks give out loans of an amount lesser than the total valuation of the shares or mutual fund investment. The amount is lesser because the bank can then charge rate of interest if the borrower is unable to repay the amount.

Mukesh. Ahlawat

Posted at 08:21h, 05 AugustPlease subscribe

NisarAhmed N Khokhar

Posted at 07:35h, 13 AugustHom loan

Ananthi

Posted at 07:19h, 14 MarchDifferent Types Of Loans In India. Prabhudas Lilladher registered his company in 1944 – PL India is now India’s leading financial services provider an official distributor of HDFC Home Loan, loan against property, loan against shares and more.

ezcashplusinc

Posted at 07:20h, 03 AprilThanks for you discusing things about home loan…

John

Posted at 17:23h, 18 AprilIt’s super helpful. Thanks for sharing!

abhishek chaurasia

Posted at 14:30h, 28 MayThank you for sharing me useful information

Tamilamuthan

Posted at 08:50h, 03 JuneGreat!! Lot of interesting stuff to read! …Thank you for sharing….

SakthishaTharsi

Posted at 11:00h, 03 JuneThanks for this post.I need more details for Agricultural Loan?

Tejashvi

Posted at 12:25h, 03 JuneThank you, for this information. This blog was really helpful. I am learning from you and Balaji credits.

SakthishaTharsi

Posted at 12:07h, 04 JuneThanks for this post.I need more details for Type Of Loans Available In India?

Gaurav Chakraborty

Posted at 09:39h, 06 JuneHello Sakthisha, Thanks for the query. Here’s a guide where you’ll get all the details about different types of loans available in the market, https://www.orowealth.com/insights/blog/types-of-loans-in-india/

Inchbank Lending

Posted at 11:32h, 06 JulyThanks for the post! I have got a piece of great knowledge. Keep sharing.

Amrita Agarwal

Posted at 08:35h, 11 JulyThanks for providing types of loans available in India. I want to take an instant personal loan. Who provides the best instant personal loan?

Bookmypersonalloan

Posted at 09:29h, 23 JanuaryThanks for sharing your innovative ideas to our vision. I have read your blog and I gathered some new information through your blog. Your blog is really very informative and unique. Keep posting like this. Awaiting for your further update.If you are looking for any Spark related information, please visit our website – Personal Loan Agency in Bangalore.

press4loans

Posted at 16:41h, 23 JanuaryGreat!! Lot of interesting information about types of loans in india, It’s help to all users. Looking for instant loan approval, save your time, also need flexible EMI options Press4loans is a Personal Loan Agency it’s help your instant cash loans for more details check with us.

Alvina Clair

Posted at 11:06h, 24 FebruaryIn India, most of the people will consider personal loans, and business loans very much. Therefore, most of the banks offer them to their customers with competitive rates. There are also some private money lenders, who offers these loans at low-interest rates. Thank you for sharing your thoughts!

DazzlerShobi

Posted at 06:17h, 02 Marchi have read your blogs so much and learn about the loan types. its an amazing information for startup who are willing to get the loans. i suggest everyone if you are going to get the loan must read this before. it will help you.

even i did blog website on loans you can check out.

ISSHU

Posted at 05:40h, 24 MarchI have read your blogs & thanks for sharing information on different types of loans available in India. Well written article!

Mittal

Posted at 07:12h, 23 AprilThis is a cool post and i enjoy reading this post. your blog is fantastic and you have good staff in your blog. nice sharing keep it up!

Blogger

Posted at 04:55h, 23 AprilThanks for sharing valuable information. Very useful content, keep posting more articles on loans.

Blogger

Posted at 04:56h, 23 AprilThanks for sharing valuable information. Very useful content, keep posting more articles on loans.

Mittal

Posted at 07:10h, 23 AprilThis is a cool post and i enjoy reading this post. your blog is fantastic and you have good staff in your blog. nice sharing keep it up!

Mittal

Posted at 07:11h, 23 AprilThis is a cool post and i enjoy reading this post. your blog is fantastic and you have good staff in your blog. nice sharing keep it up!

Carry Richard

Posted at 11:41h, 09 JulyThanks Gaurav for making me aware about the different aspects loans in India.

Sourabh

Posted at 05:17h, 09 OctoberVery great content and Really amazing information about Types of Loans In India.

Seth

Posted at 18:09h, 28 MayYour article gives very clear information about each factor which one must consider before starting a business