How to setup a SIP in under 2 minutes

The biggest problem in setting up a SIP is that it is a tedious process and takes a month to complete the registration. It involves printing, signing and physically mailing a NACH mandate form. And once you’ve done that, the process goes on for another 3-4 weeks. If the banks reject your mandate, you’ve to restart the whole process all over again.

Don’t worry, we have created a very simple workflow where you can complete your on-boarding and setup a SIP in under 2-minutes.

Here is how you do it:

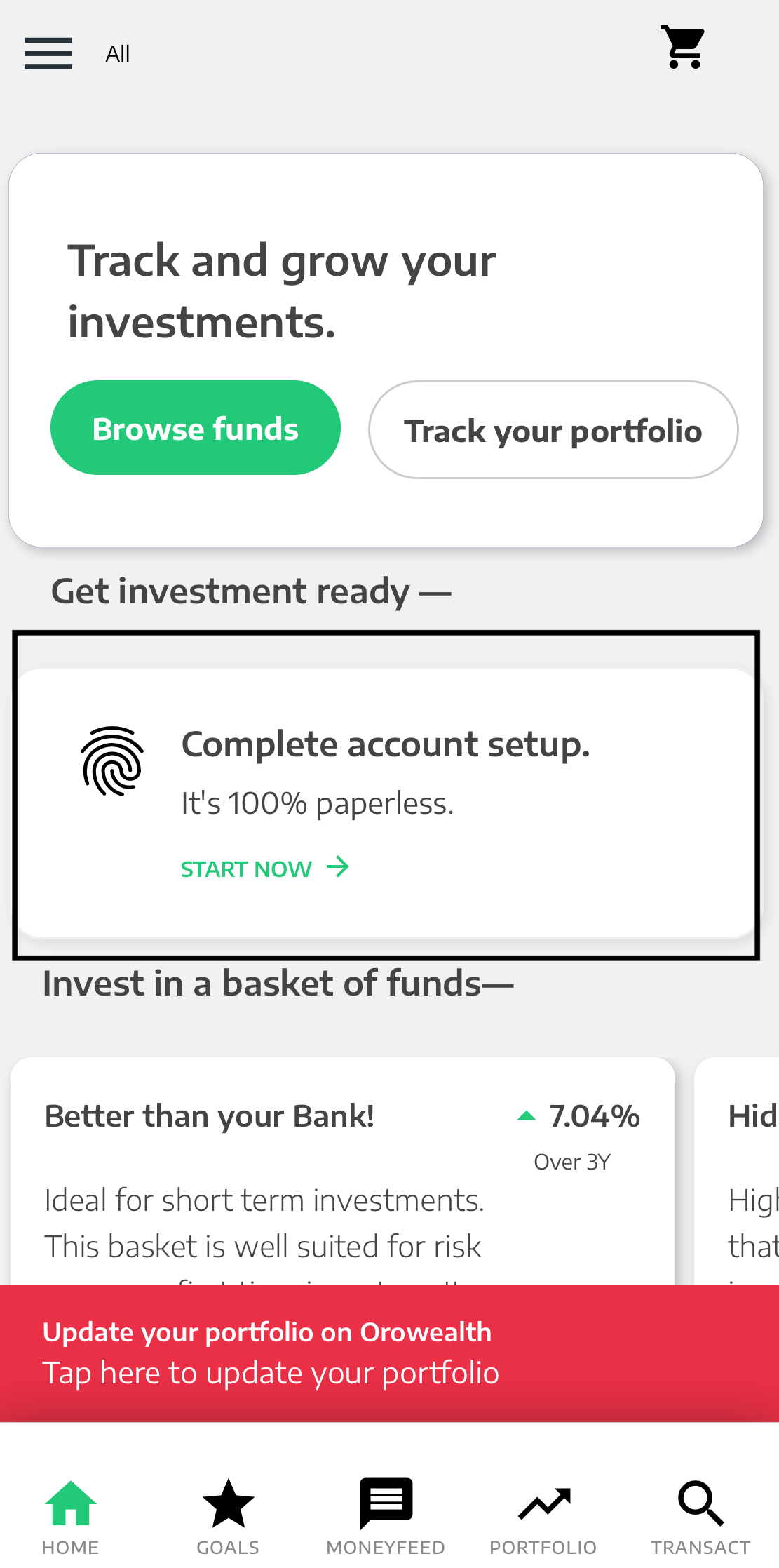

STEP 1: Complete your On-boarding:

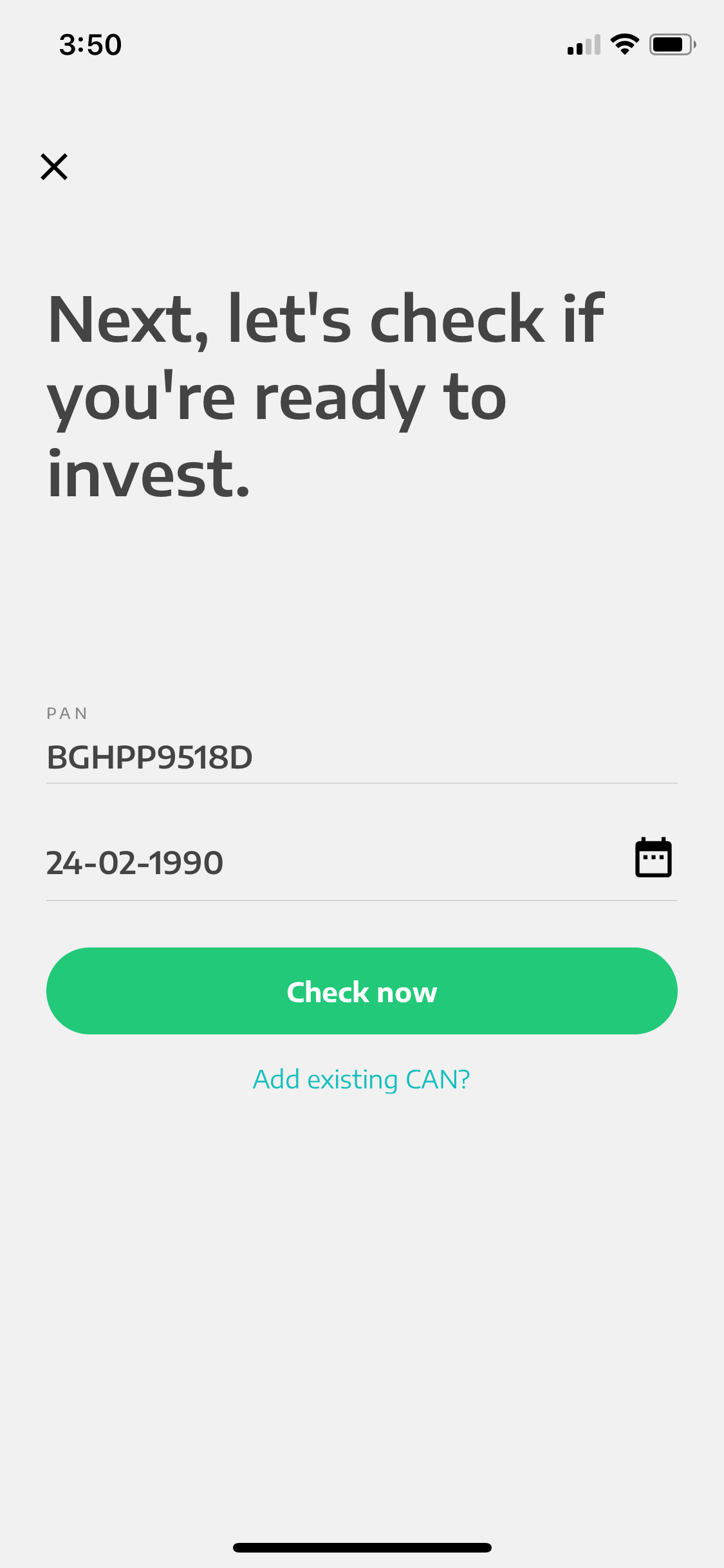

Add your PAN & Date of birth (this to verify your KYC information):

PAN/Date of Birth Entry:

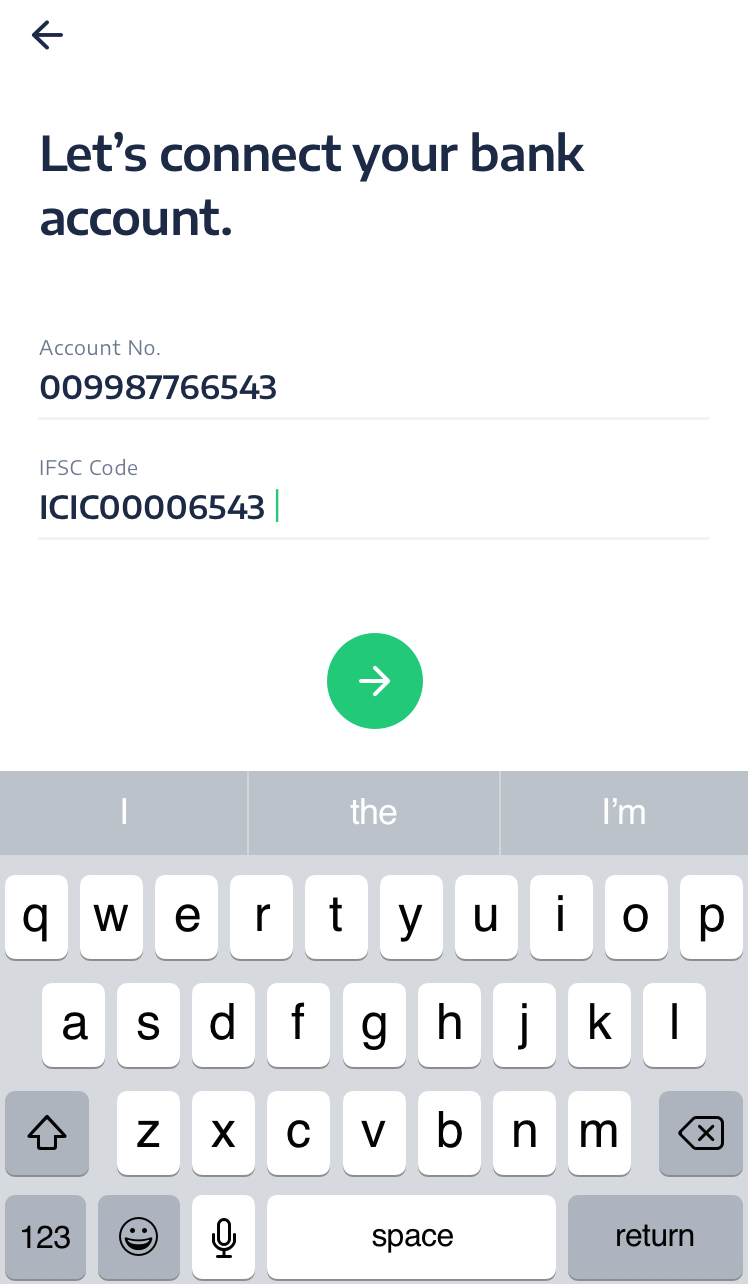

Add your Bank A/c no & IFSC Code: (we will send you Rs. 1 to verify your bank account information):

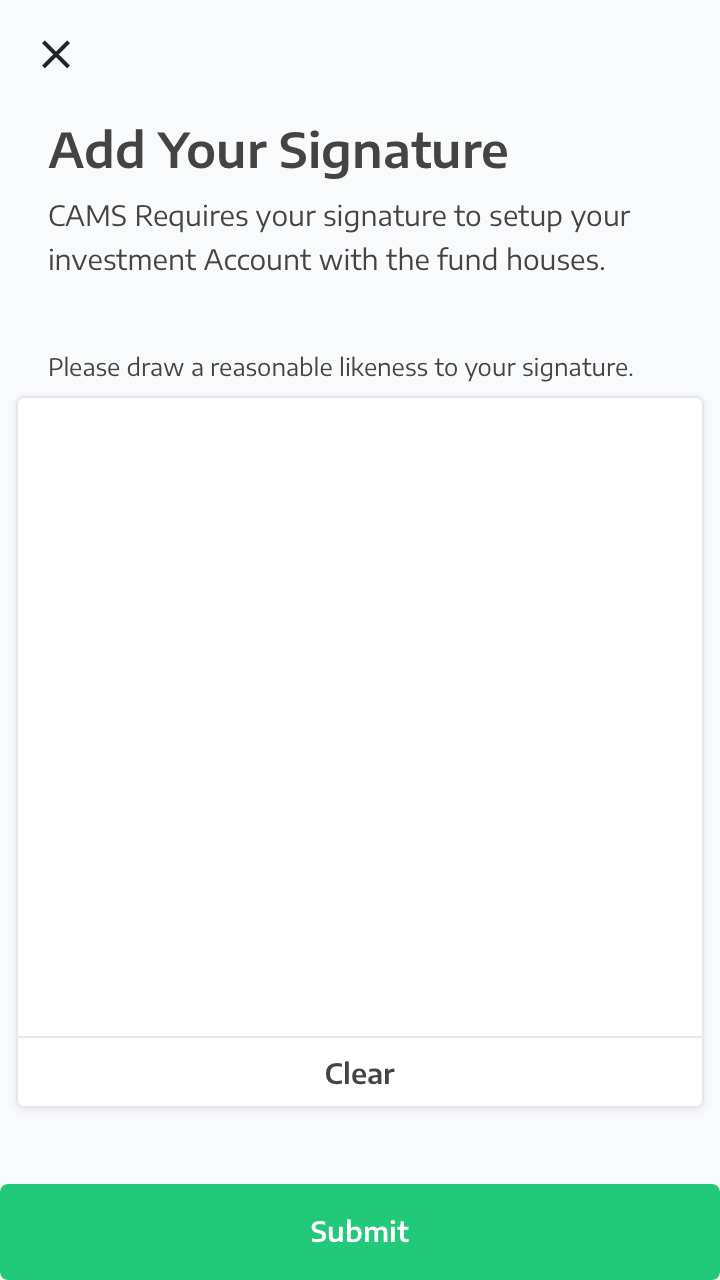

Signature (AMC/RTA’s requires your signature to setup your account):

Your on-boarding is complete.

STEP 2: Setup a SIP:

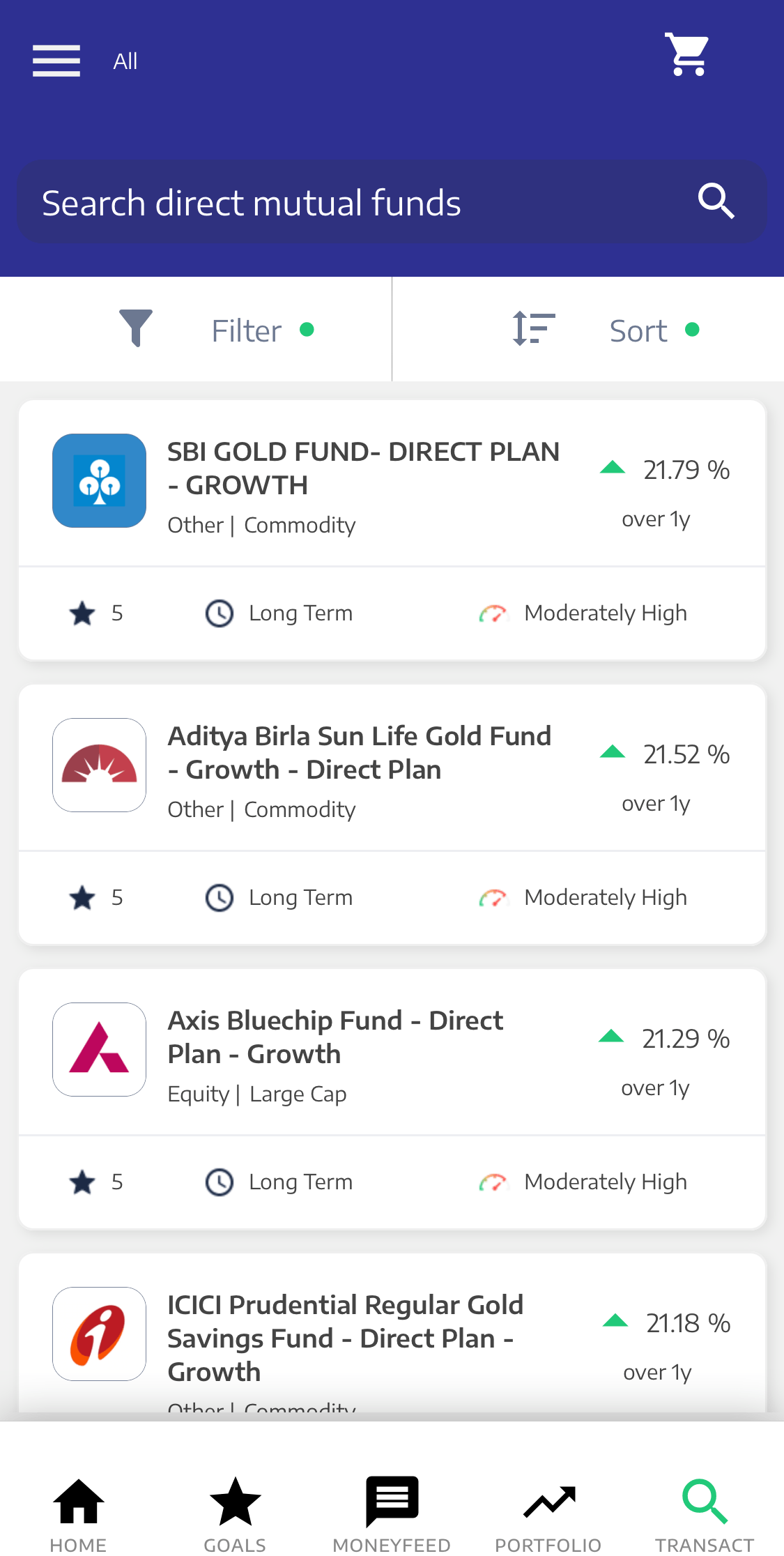

Select a Fund: (Don’t know which fund? Select “Top Picks”, it will give you the best rated funds by Orowealth.

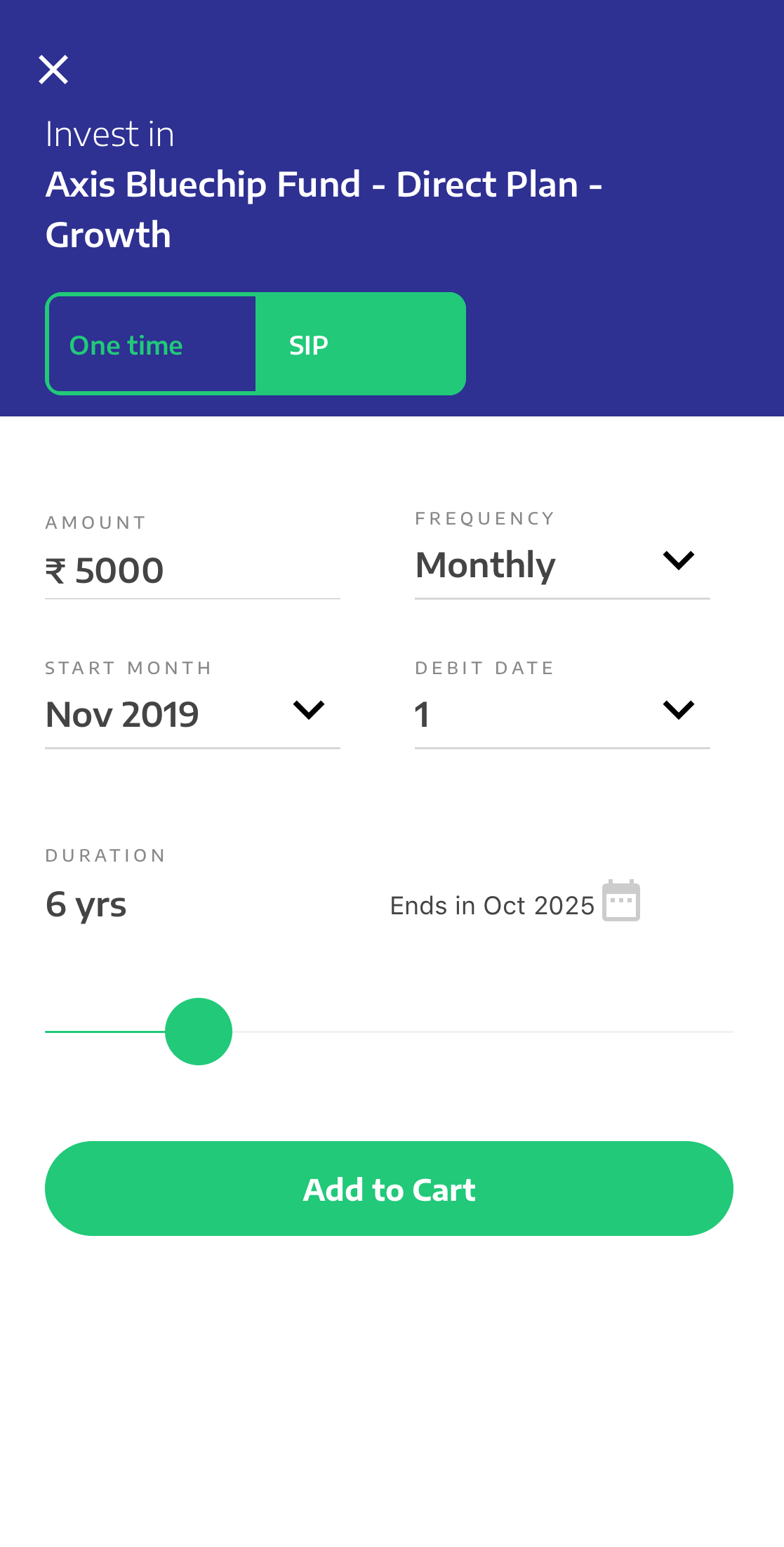

Select Amount, date, frequency & duration:

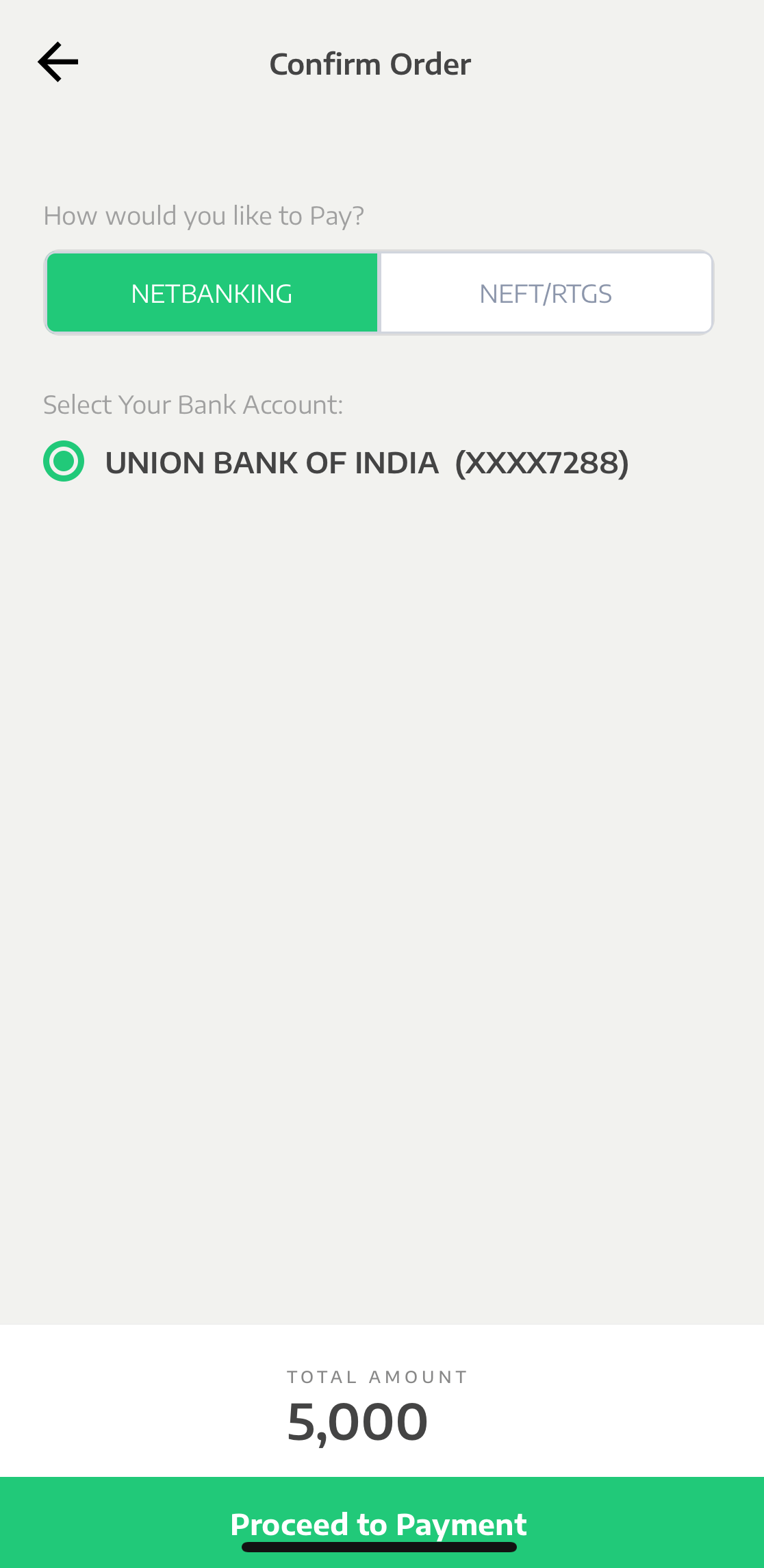

Use either Netbanking/NEFT to complete your first transaction, after this transaction your transaction amount will be invested in this fund on your selected date.

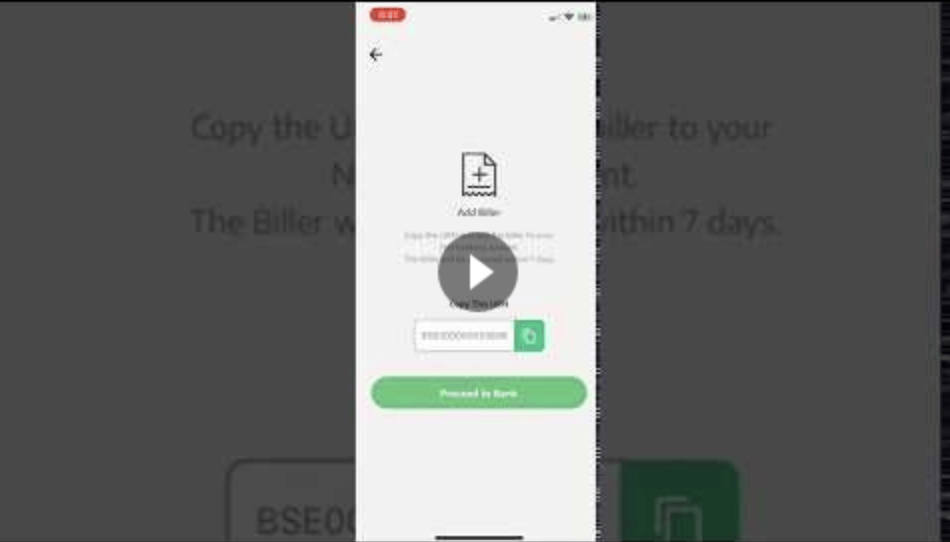

Once you’ve completed your SIP transaction don’t forget to setup a Biller to ensure all your future installments are successfully processed.

Follow the link below to check out the biller process: https://www.orowealth.com/insights/blog/how-to-add-a-biller-to-start-a-sip-online/

See the video below to check out SIP setup:

Feel free to email us at connect@orowealth.com if you have any questions.

Rahul

Posted at 16:10h, 22 Octoberwow very quick process & user friendly thanks Angelo Soares

Santosh H

Posted at 17:36h, 25 DecemberThanks for these steps. Important aspect is nominee, how do I register nominee for the MFs through SIP or lumpsum ?

Gaurav Chakraborty

Posted at 06:11h, 06 JanuaryHello Santosh, Request you to connect to the respective AMC or you can also register on the MFU website.