SIP Meaning – Everything You Need to Know About SIP

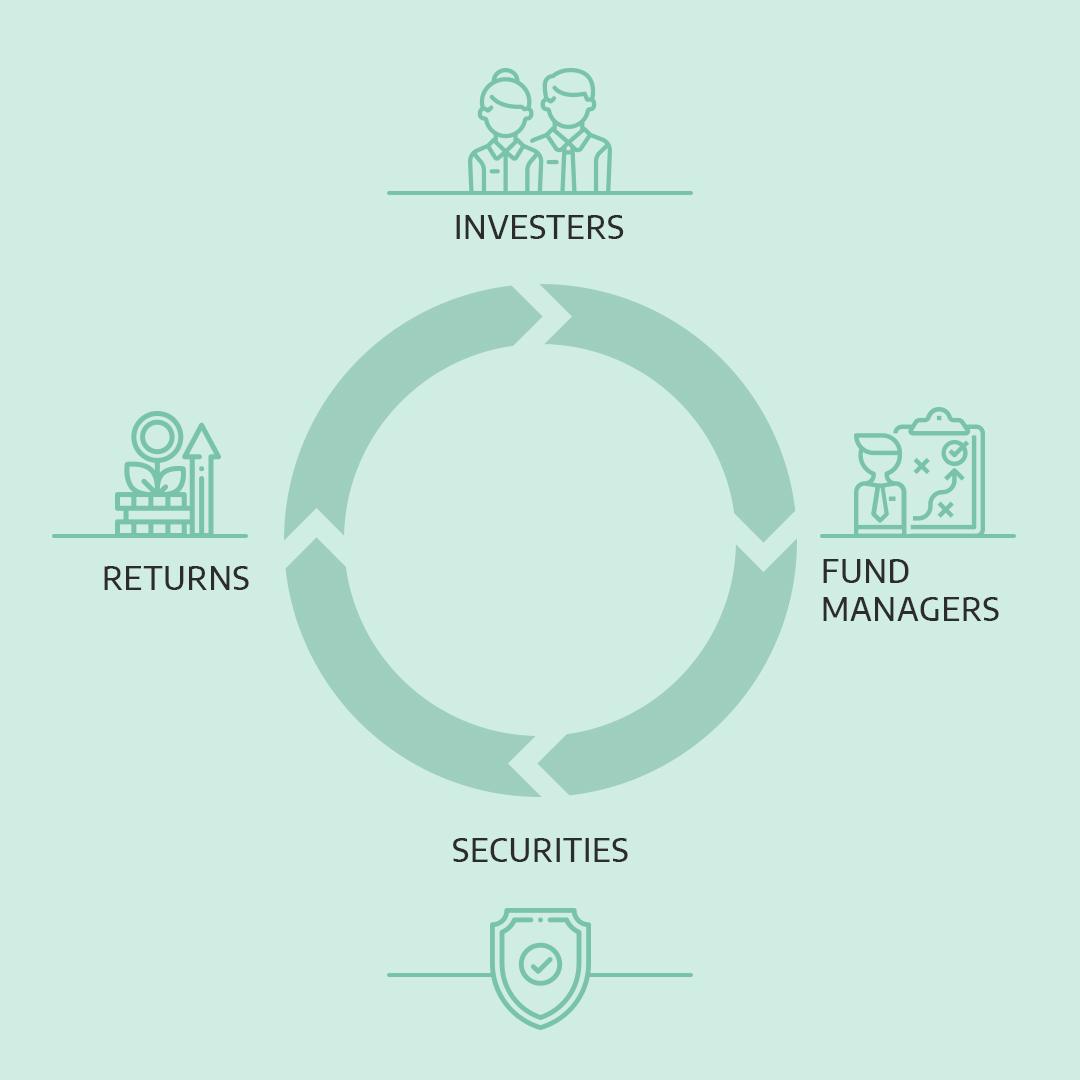

What is SIP? SIP or a Systematic Investment Plan is a tool or an arrangement that helps you to invest a pre-determined amount at regular intervals. Usually, these intervals are monthly and have a pre-set date but the intervals can also be weekly/quarterly/semi-annually or annual basis. SIP...