Direct Mutual Fund vs Regular Mutual Fund – The Difference

Any Mutual Fund scheme offered by the Asset Management Companies (AMCs) has two variants – a direct Mutual Fund scheme and a regular Mutual Fund scheme. Both the variants offer the same portfolio composition and the Assets Under Management (AUM) are also identical. Moreover, they both have the same fund managers. However, the critical factor that separates the two is the expense ratio. The expense ratio is a percentage that you pay to the fund house for managing your investments.

Before getting into the details of it, let us first understand the basics of it and understand the difference between direct and growth mutual funds.

What is a Direct Mutual Fund Scheme?

A Direct plan is what you buy directly from the mutual fund company (usually from their own website). It is sold by the Registered Investment Advisors (RIAs) along with the regular AMC. The expense ratio of these direct Mutual Fund schemes is slightly lower than their corresponding regular plans as a result of which these funds make more profit. This higher profit can be seen in terms of higher NAV as compared to the regular plans.

Read More: Everything you need to about Net Asset Value (NAV)

What is a Regular Mutual Fund Scheme?

As you must have guessed by now, a Regular plan is what you buy through an advisor, broker or distributor (intermediary). In a regular plan, the mutual fund company pays commission to the intermediary. This is the reason why regular mutual funds have slightly higher expense ratios and lower NAV as compared to their direct counterparts.

There is a substantial difference in the returns you receive when you invest in Regular Mutual Fund plans as compared to the Direct Mutual Fund plans.1-2% of your investments are being eaten every year by your agent/broker via commissions when you invest in Regular Plans.

*A trailer fee is the annual service commission paid by the mutual fund company to the mutual fund sales representative (In this case brokers, intermediaries)

Still, don’t believe us?

Let us show you some data:

Direct Mutual Fund vs Regular Mutual Fund

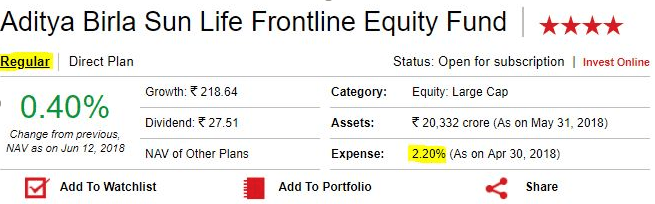

ABSL’s regular mutual fund plan with an expense ratio of 2.20%

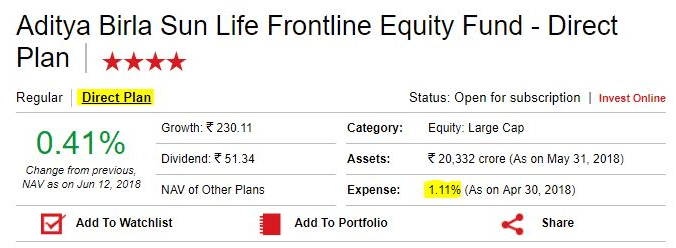

ABSL’s direct mutual fund plan with an expense ratio of 1.11%

If you look at both the images above,

In Image 1, ABSL Frontline Equity Regular Plan has an expense ratio of 2.20% whereas, in Image 2, the same fund, ABSL Frontline Equity Direct Plan has an expense ratio of 1.11%.

Why the difference in expense ratio?

The difference in expense ratio between these two modes of investments, which in this case is 1.09%, is paid out as commissions to your agent/broker.

Yes, you heard us right. Let us take an example here,

Read More: Everything You Need to Know About Expense Ratio

Let’s say Ajay is doing a SIP of INR 10,000 every month in ABSL Frontline Equity Regular fund and he is investing in the fund for 10 years. The annual return of this fund is 17.81%.

And, let’s take Swati who is doing a SIP of INR 10,000 in the ABSL Frontline Equity fund Direct Plan. Let’s assume she also invests for 10 years. The annual return rate of the same fund in direct is 18.95%.

| AJAY (Regular) | Swati (Direct) | |

| Final Amount | Rs. 24.6 Lakhs Approx. | Rs. 23 Lakhs Approx. |

| Invested Amount | Rs. 12 Lakhs | Rs. 12 Lakhs |

| Wealth Gain | Rs. 11 Lakhs Approx. | Rs. 12.6 Lakhs Approx. |

The difference in wealth creation in the same fund for the same time duration is INR 1.6+ lakhs. This means Ajay has actually lost Rs1.6 lacs in commissions to his agent/broker which he could have saved if he had chosen the direct plan.

You might think 1.6 Lakhs is a big amount to lose. Let’s assume that these two continue the investments for the next 10 years.

For a duration of 20 years, considering the same investment amount, the comparison between Ajay’s and Swati’s returns will be,

| Ajay (Regular) | Swati (Direct) | |

| Final Amount | Rs 97.4 Lakhs Approx. | Rs 1.1 Crores Approx. |

| Invested Amount | Rs 24 Lakhs | Rs 24 Lakhs |

| Wealth Gain | Rs 73.4 Lakhs | Rs 89.8 Lakhs Approx. |

The difference in returns after being invested for 20 years is INR 16.4 Lakhs. (That’s a lot of money, don’t you think?)

The whole concept of Direct mutual funds was introduced by SEBI in 2013 to help retail investors save money that is lost in mutual fund commission. The sad truth is that many investors are not even aware that they have been losing big chunks of their returns to their agent/broker.

A study shows, only 11% of the investors investing in mutual funds are aware that Direct Mutual Funds exist.

What you’ve seen above is an example of one fund where the commission is 1.09%. There are funds where investors may lose up to 2% as commissions per annum. If you apply the power of compounding, the results are humungous.

Thus, direct investing gives you a way to keep your investments in your hand.

Investing in mutual funds is the most proven, safest and efficient way of creating wealth. We at Orowealth, being pioneers in the Direct Mutual Fund industry have taken a pledge to change the commission-driven model of investments and make investors take control over their personal finances.

No Comments