Mutual Funds – A Detailed Guide

What are Mutual Funds?

A mutual fund is an indirect way of investing in equities, bonds, money market instruments, and other financial assets. It is like a group buying program for securities, where a large number of investors deposit money in a collective pool to be used by an expert, a.k.a. the fund manager, for buying a bucket of securities, called a portfolio, based on the fund’s investment objective. Here in this article, we are going to discuss everything you need to know about mutual funds. We will be covering the investment objective, how mutual funds work, how to invest in mutual funds, pros and cons of mutual funds, and benefits of investing in mutual funds. So let’s dive into the matter.

The company that floats owns and operates a mutual fund is called a fund house. It also goes by the name of an Asset Management Company (AMC). Some of the prominent AMCs in India are Aditya Birla Sun Life Mutual Fund, Franklin Templeton Mutual Fund, HDFC Mutual Fund, DSP Mutual Fund, ICICI Prudential Mutual Fund, and SBI Mutual Fund, etc. There are more than 20,000 mutual fund schemes in India managed by 40+ fund houses.

The price of a mutual fund is denoted by Net Asset Value or NAV of one unit of the scheme. NAV is calculated by dividing the market value of securities held by the fund by the total number of units of the fund. Movement in NAV denotes the performance of the fund, just like a movement in share price. Before educating yourself about how to invest in mutual funds, let us first understand why you should invest in mutual funds.

In this article, we will cover the Objectives of Mutual Funds, their various types and the benefits of investing in such funds. We will also through light on how it is beneficial for the investors to park their funds in Mutual Funds and also share a complete guide as to what are the pre requisites in terms of documentation and other formalities so that an investor can buy these funds.

Objectives of Mutual Funds

The objectives of mutual funds can vary, depending upon the type of fund you choose to invest in. Nonetheless, a few common objectives across the various genres are:

- To maximize the expected returns and minimize the potential risks.

- Long-term growth of the invested funds.

- To generate a steady cash flow/liquidity.

- Reap the benefits of portfolio diversification.

- Attain a certain level of security in an uncertain market.

- Gain from the financial knowledge of fund managers.

- Maintain a stable pool of income for future reinvestment.

- Create sustainable profits.

In order to be truly aware of the financial goals which a mutual fund can help you achieve, it is vital to know about the different types of mutual funds and what they are comprised of.

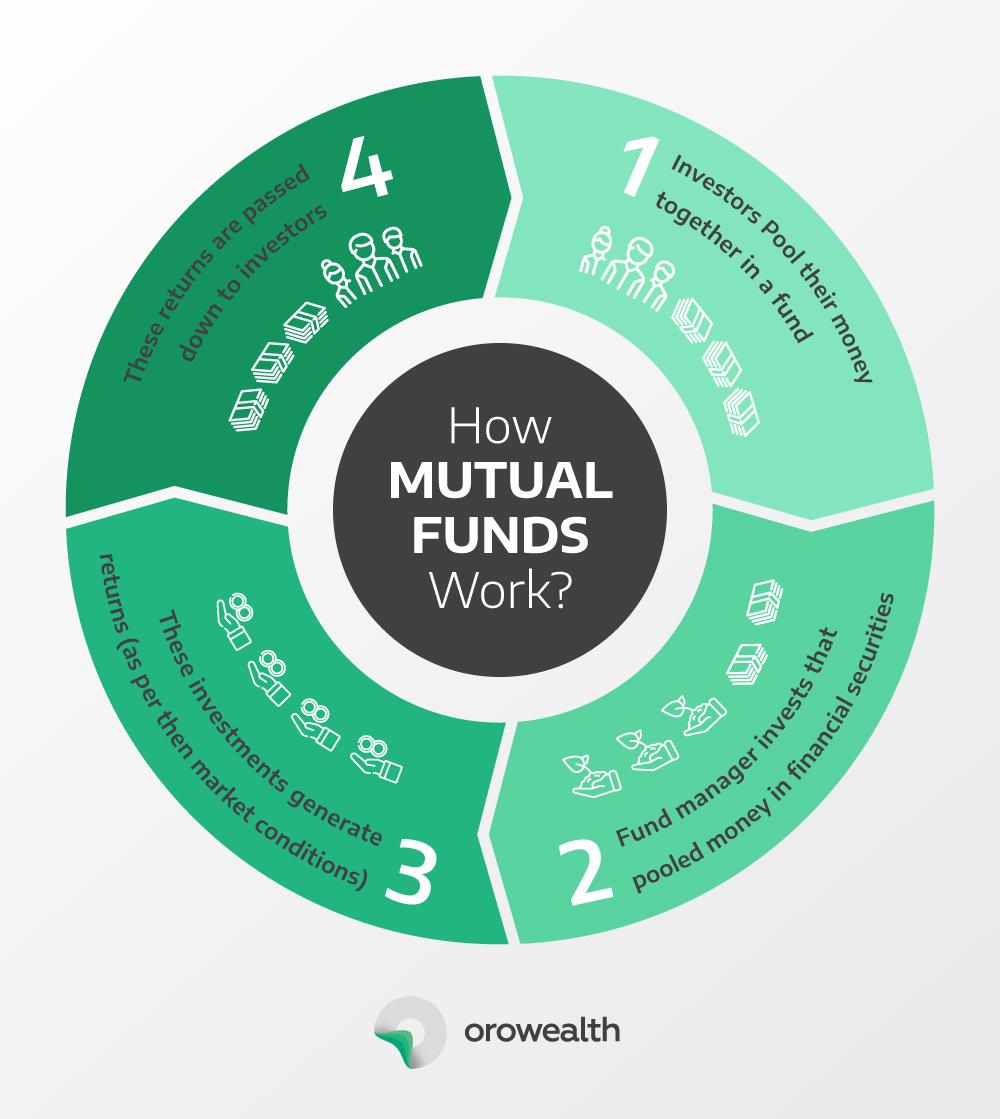

How do Mutual Funds Work?

Here’s a graphic that will tell you how mutual funds work:

Different Types of Mutual Funds

As per the Categorization and Rationalization of Mutual Fund Circular issued in October 2017 by Securities and Exchange Board of India (SEBI), all mutual fund schemes in India need to fall into one of the following categories:

- Equity mutual funds

- Debt mutual funds

- Hybrid mutual funds

- Solution-oriented mutual funds

- Other mutual funds

Within these categories, an AMC can float schemes based on parameters like market capitalization (large-cap, mid-cap, small-cap), investment time frame (for debt schemes), the proportion of equity and debt, and investment strategy.

1. Equity Mutual Fund

Funds falling in this category invest directly in the stock market. These funds are categorized as high-risk and high-return. It gives a higher return because the money collected in these funds are invested in the stock market and are riskier because they are subjected to the volatility of the market. These funds are riskier in the short term. There are 10 types of equity schemes as detailed in the Categorization and Rationalization of Mutual Fund circular.

2. Debt Mutual Fund

These funds invest in debt instruments. Funds falling in this category provide lower return and the risk is also low when compared to equity funds. There are 16 types of debt schemes as categories in the SEBI’s October circular.

3. Hybrid Mutual Fund

Hybrid schemes offer the best of both worlds. These funds invest both in equity as well as debt. This fund type has been further divided into 6 categories based on asset allocation and investment style.

4. Solution-oriented Mutual Fund

As the name suggests, the solution-oriented schemes are floated with a particular solution in mind like retirement and child education. There is a mandatory lock-in period of 5 years in these funds. This means that if you invest in any solution-oriented mutual fund, you cannot withdraw your money before 5 years of the investment or child’s maturity (in case of children fund) and retirement (in case of retirement fund), whichever is earlier.

5. Other Mutual Funds

Index Funds or ETFs and Fund of Funds (FoF) falls in the other scheme categories. For a scheme to qualify as ETF, a minimum investment of 95% of total assets is required in securities of a particular index (which is being replicated/ tracked), and for a FoF, a minimum investment of 95% is required in underlying funds. FoFs can have both domestic and global exposure.

6. Open and Close-ended Mutual Fund

Based on the structure of a fund, a mutual fund can also be classified in one of two categories: Open-ended and Close-ended.

Units in an open-ended mutual fund are continuously bought and sold, so an investor can enter or exit the fund at any point, as per her convenience. This is not so in a close-ended scheme. The units in such schemes can only be bought at the time of New Fund Offer (NFO) and one cannot exit it before the end of a stipulated period. Let us now see what all you need to invest in mutual funds.

Documents Required for Mutual Funds

Any person, who is an Indian citizen, can invest money in a mutual fund. There is no limitation on the amount of money which can be invested. It can be as small or as large a corpus, as your finances allow.

Even so, you need to submit the following documents for buying mutual funds:

- An application form detailing the mutual fund plan/scheme you are applying for.

- KYC compliance acknowledgment letter.

- A proof of identity, which could either be a PAN card, Aadhar card, Passport, Voter ID card or driving license.

- A valid proof of current address.

- A signed cheque containing the amount of money you want to invest.

- A third-party declaration form if the investor is a minor.

- If the investor is a non-individual i.e. a company, a partnership firm, a Hindu undivided family or a trust, they are required to additionally submit a certificate of incorporation, a memorandum of association, a list of authorized signatories, a bank statement and a self-certified letterhead.

These documents aid the verification process and thus, help prevent financial fraud and tax irregularities.

Benefits of Investing in Mutual Funds

Though mutual funds are largely advantageous, there are a few pitfalls of the instrument too. It is, therefore, important to weigh both sides of the scale before coming to an investment decision. Their advantages include:

a. Liquidity

Being invested in a fund makes it easy to purchase and exit from a scheme. The investors are free to sell their units and withdraw from the scheme at their will. This keeps the cash flow liquid.

b. Diversification

Since the investment is made in more than a single asset class, the risks are spread and the portfolio is diversified. This ensures that if one asset does not perform, another one can compensate for the loss.

c. Expertise

The investors don’t need to conduct any research on their own. Instead, professional fund managers, who operate mutual funds, use their expertise to determine which fund to buy and when to withdraw.

d. Goal-Oriented

No matter what your income and expenditure habits are, there is always a mutual fund which will suit both, your specific financial goals and your risk appetite.

e. Hassle-Free

The entire process of investing in a mutual fund is quick, responsive and hassle-free. Maintaining the fund too requires no extra effort. You can start slowly and eventually branch out into other funds.

f. Tax-Efficient

A number of mutual funds offer tax deductions under section 80(C) of the Income Tax Act. As of now, only a long-term capital gains tax (LTCG) is applicable at a rate of 10%, after the first year of investment.

Disadvantages of Mutual Funds

a. Costs

Fund managers charge a commission, which is added to the expense ratio of the fund. This makes it a costly tool to buy. More so, even after paying the manager’s fee, better fund performance is not guaranteed.

b. Lock-In

A few mutual funds have a long-term lock-in period. This ranges from about five to eight years. If you want to exit before the predetermined maturity date, you might have to incur some extra expenses.

c. Fluctuations

Market fluctuations can hamper the final returns which an investor expects to obtain. So much so, that at times, even the basic value of the principal amount might be depreciated.

d. Control

The presence of fund managers can both be a boon and a bane. Once the fund is under their charge, investors might not have much control over their investment. They are only free to examine disclosure norms and overall investment strategy.

Despite these disadvantages, mutual funds can provide a semblance of stability and reliability, especially at a time when market dynamics are continuing to change every day.

Growth, Dividend, or Dividend Reinvestment Plans

When investing in a mutual fund, you are presented with three plans: Growth, Dividend, And Dividend Reinvestment. This is the same across all schemes, so you should know a bit about it.

In a Growth Plan, the profit made by the funds is not paid to the investors. These are reinvested in the market. This is beneficial for long-term investors, as they reap the reward of compounding.

In a Dividend plan, a periodic dividend is declared by the fund out of profit made on the investment. The dividend is then paid to the investor. This may result in a small payment from investment, but NAV of the dividend plan is reduced in proportion to the dividend payout.

Dividend Reinvestment Plan is similar to the dividend plan with one difference. The dividend issued under this plan is not paid out to the investor but used by the fund manager to buy additional units for of the same scheme

How to Invest in Mutual Funds?

A mutual fund investment can be undertaken either online or offline. Here are a few steps you must follow to do this:

- Step 1: To begin with, identify what is your investment objective. Do you have a specific goal to chase or are you simply investing to build wealth? Clarity on this part helps zero-in on the options available.

- Step 2: Find out which plans and schemes are available. Consider the risk and reward factors associated with that scheme and check how it has performed in the past.

- Step 3: Choose a fund house and submit your documents to them. They will verify your credentials and make sure that you comply with the know your customer (KYC) guidelines.

- Step 4: If you’re doing the investment offline, visit the nearest asset management company, bank branch, MF utility or whichever other intermediaries you have chosen and fill in the application form. Once this form and the documents have been submitted, your fund will be activated within 6-7 working days.

- Step 5: If you’re considering the online option, visit the fund house’s website and simply follow the instructions. You will have to upload the same documents, fill in an online application form and submit your e-KYC details. After these have been processed, the fund will be active within 2-3 working days.

From January 1, 2013, it was made mandatories for AMCs to roll out a direct plan for all its schemes along with the pre-existing regular plans.

Direct and Regular Plan

In the context of mutual fund investment, regular plans are the ones that you buy through an intermediary like a broker, distributor, or bank. These intermediaries are paid a distribution fee by a fund house, which adds up to the expense ratio. This, in turn, reduces the profitability of the scheme.

The direct plan, on the other hand, has a lower expense ratio because there are no intermediaries between you and your AMC, which translates into a higher return on investment. But there are downsides to the direct fund. The first downside is you need to go to each of the AMC’s website and register yourself to invest in their mutual fund schemes, which will eat away a lot of your time. You will also need to visit these websites periodically should you wish to track your investment, which you must do. The third problem is related to a research recommendation. As you do not have a broker to find the best funds to meet your investment objective, your portfolio may end-up underperforming.

Fortunately, these shortcomings are addressed by Orowealth, which help you buy all kinds of direct mutual funds from one place and monitor your portfolio’s performance. Not only that, it also gives you a dedicated advisor to help you maximize your return on investment by understanding your investment objective, risk appetite, and investment style.

Costs Associated with Mutual Funds

i. Entry Load

It is a charge levied by an AMC on the purchase of mutual funds. A fund house levies this charge to cover the distribution cost. Entry cost varies from AMC to AMC, but it is around 2.25% of the investment value. Most of the AMCs have made the Entry load as Nil.

ii. Exit Load

An AMC may also levy a certain charge when you sell off your units before a set period. This can be anything between 1-3%.

iii. Total Expense Ratio (TER)

A fund house incurs certain expense in running and maintaining a mutual fund. This cost is borne by the investors as part of the fund’s TER or expense ratio, which is generally between 1.5% and 2.5%.

iv. Transaction Charge

An AMC can take ₹150 as transaction charge from a new investor and ₹100 from an existing investor on investment of ₹10,000 or more.

v. Dividend Distribution Tax (DTT)

DTT is paid by the company issuing dividends on the grossed-up amount of dividend, which in case of mutual funds means that dividend paid by fund houses are taxed as DTT at the rate of 10-15%.

vi. Capital Gain Tax

As announced in the budge, from April 1, 2018, long-term capital gain tax (LTCG) of 10% has been levied on equity mutual funds that have equity exposure of 65 percent or more when long-term capital gains go above Rs 1 lakh in a year.

A short-term capital gain tax (STCG) is applicable to funds that are sold before 1 year of the purchase. STCG rate for equity mutual funds that have equity exposure of 65 percent or more is 15%.

vii. Security Transaction Tax (STT)

The government also levies STT on equity-oriented mutual funds.

viii. Other Charges

Apart from the above mandatory charges, a mutual fund investor may incur costs like demat account opening and maintenance cost, and brokerage commission, etc. Brokerage commission on a regular plan alone can eat up 1% to 2% of your profit, every year, which may not sound much, but it quickly adds up in the long-term. You can save this cost by investing in the direct mutual fund through orowealth. It will save you anything between thousands of rupees and lakhs of rupees depending upon your investment amount and time frame.

Top 10 Mutual Funds in India

Here is a quick reference guide on top 10 mutual funds in India

| Fund Name | Returns | Risk | Category Average | AUM | ||

| 1-Y | 3-Y | 3-Y | Return 3Y | Risk 3Y | ||

| SBI Blue Chip Fund | 11.4 | 10.0 | 12.3 | 7.0 | 13.8 | 176.6 |

| Aditya Birla Sun Life Frontline Equity Fund | 9.6 | 9.1 | 12.9 | 7.0 | 13.8 | 197.0 |

| Kotak Standard Multicap Fund | 11.6 | 12.4 | 13.7 | 7.0 | 13.8 | 178.0 |

| Reliance Small Cap Fund | 29.7 | 23.1 | 18.6 | 13.8 | 16.2 | 66.1 |

| Mirae Asset Emerging Bluechip Fund | 13.9 | 17.8 | 14.3 | 13.8 | 16.2 | 51.3 |

| ICICI Pru Focused Equity Fund | 13.3 | 9.9 | 13.1 | 7.0 | 13.8 | 162.8 |

| Franklin India Smaller Companies Fund | 18.0 | 16.3 | 14.0 | 13.8 | 16.2 | 71.3 |

| Franklin India Focused Equity Fund | 11.5 | 9.1 | 15.4 | 9.9 | 14.3 | 76.4 |

| ICICI Pru Balanced Mutual Fund | 11.4 | 12.1 | 10.3 | 8.2 | 10.1 | 278.0 |

| HDFC Balanced Fund | 13.0 | 11.4 | 10.3 | 8.2 | 10.1 | 201.9 |

Note: Returns (in %) as of March 23, 2018, Risk is standard deviation (%) – as of February 28, 2018, AUM is in Rs billion, as on February 28, 2018.

Step-by-Step Guide to How to Invest Mutual Funds

1. Get a PAN card

Having a PAN card is a must for undertaking any financial activity, including mutual fund investment. You will need to provide your passport size photograph, documents to verify your identity, date of birth as well as address (click the link for a list of documents accepted as proof of identity and address) If you have Aadhar number than that would be sufficient for the same. You can apply for PAN via an agent or directly by visiting NSDL portal or UTITSL website. It takes 15-20 days for PAN to arrive at your given address. The Income Tax department has also beta tested instant e-pan feature, which might be available in the future.

2. Get Aadhar number

You may also need an Aadhar number to get a bank account, so you should consider getting one if you do not have that.

3. Get a Bank Account

You will need an IFSC and MICR complaint bank account that allows electronic fund transfer facilities like NEFT, RTGS, IMPS, and ECS. If it is possible, get a bank account with mobile and internet banking facilities. This will make the whole process easy.

4. Complete Your KYC Compliance

As per the Prevention of Money laundering Act, 2002, KYC (Know Your Customer) compliance with SEBI is required for mutual fund investments, or for any securities transaction. You need to visit a local CAMS KYC center with your original documents as well self-attested photocopies of the documents along with your recent passport size photographs. The list of documents required for KYC is same as mentioned in the section on PAN application. After submitting your KYC application, you can check your KYC compliance status on CAMSKRA using your PAN number or Aadhar number. Alternatively, you can visit the following KYC Registration agencies to check the status of your application or to get your KYC compliance done.

5. Know Your Investment Objective

Once you have done the basic preparation, you need to assess your financial goal in terms of how much money you will need in the future when you will need it, and how much are you willing to invest now to attain that goal.

6.Select a Type of Mutual Fund

Based on the objective you need to decide what kind of fund you want to go for, and whether you will go for an open-ended scheme or a close-ended scheme. It will also help you decide whether you should go for growth option or dividend or dividend-reinvestment option.

Direct Mutual Funds or Regular Mutual Funds?

In this step, you need to decide if you want to go for a direct plan, which gives you a better return, or you are willing to sacrifice 1% – 2% profit per year to a regular plan.

For a direct plan, you can open a free account with Orowealth and set yourself on the path to riches. Alternatively, you can visit the websites of 40+ AMCs operating in India and choose from 20,000+ funds available.

In case you want to invest via an intermediary then you will need to approach a broker or distributor using their website, mobile app, or visiting their office in person. For this purpose, you might be asked to open a demat account with the broker, though not necessarily.

Transfer Funds

In either of the case, you will need to do a fund transfer to your account or to AMC. Electronic money transfer is the most convenient way of transferring fund instantly for the fund of your choice. You can also visit your bank to do the transfer or write a cheque.

Do You Want to Do SIP or a Lump Sum Investment?

Your objective and the availability of fund will dictate your choice here. Having said that, you must do a SIP, however small, in the fund of your choice, even when you are going for a one-time investment. SIP is a slow but an effective way to build wealth from mutual funds.

When going for a SIP, you should choose the SIP date and amount that suits you. Once set, make sure you have the specified amount in your bank account on the set date. The SIP amount is directly debited from your bank account on the fixed date, each month.

Click Buy and Wait for Money to Grow

Once all done, the only thing left is to make the purchase and wait for the money to grow. To get a better return on your investment and reduce the risk on capital invested, you should always diversify, which is to say, you should not put all your money in one fund or one type of fund.

Prakash M Patil

Posted at 17:50h, 22 AprilExcellent information regarding mutual funds. Now I am investing Rs10.000/ Icci prudential blue chip fund, Rs10000/ Katak Standand multicap fund and Rs10,000/ in UTI Equity core fund growth. Total Rs 30,000/Monthly since 1year 6Month. All are in large cap. I want invest for 10 years

orowealth.com

Posted at 13:39h, 12 JunePlease note a fine present for you. orowealth.com