Balanced Funds

What are Balanced Funds?

Balanced funds are mutual funds, which provide exposure to both equity and fixed income classes, or bonds, in a sizable measure. They get their name from the ‘balance’ that they try to strike between the two aforementioned asset classes.

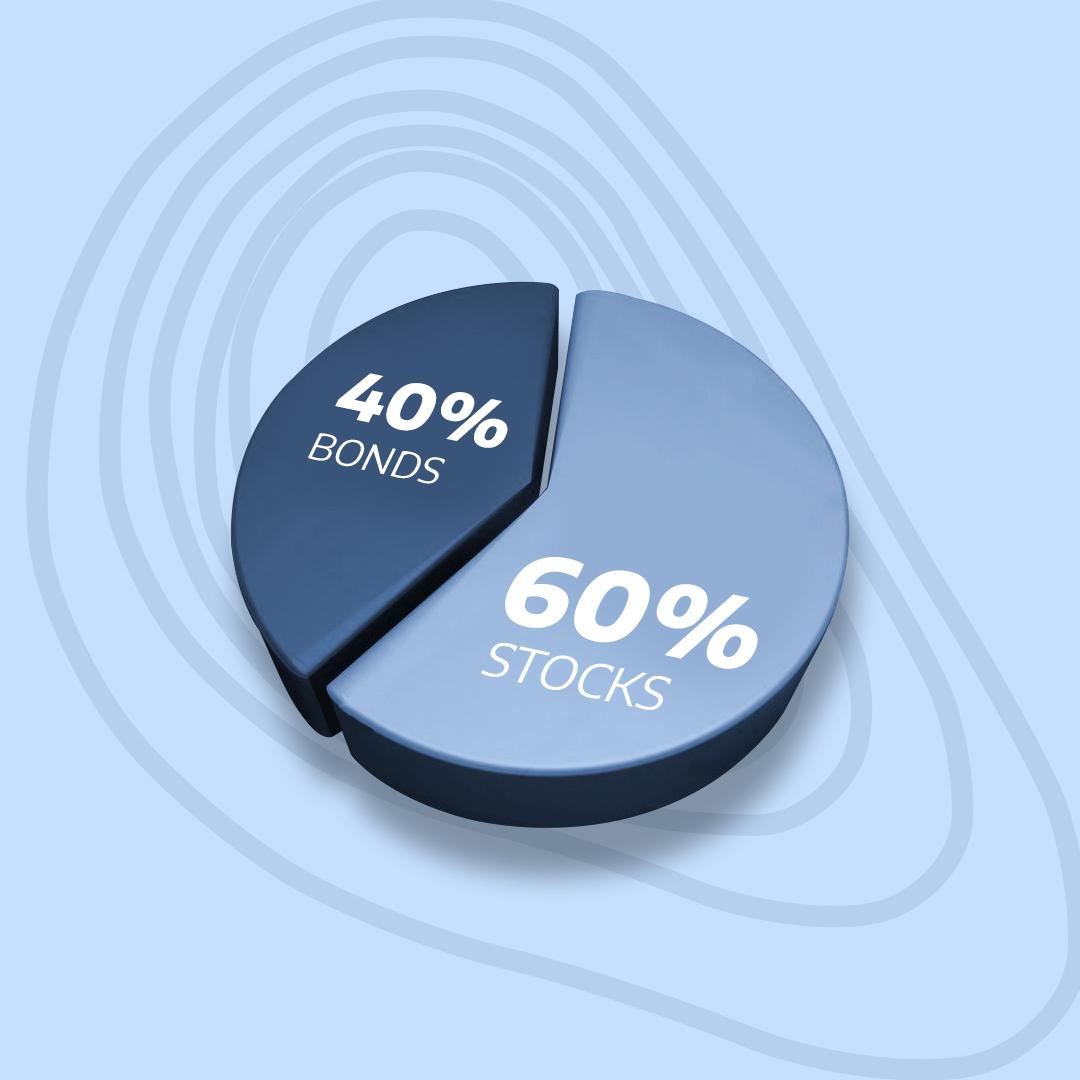

While equity mutual funds typically have more than 85% of their assets invested in stocks with the remaining in bonds and money market instruments, debt mutual funds invest similar amounts in those bonds and fixed income products which help them achieve their investment objective. Balanced funds typically invest 55-65% of their assets in stocks and the remaining in bonds and money market instruments. Thus, though the ratio of allocation between stock and bonds in balanced funds is not 50:50, it is still more balanced than an equity or debt oriented mutual fund, resulting in the fund’s nomenclature.

Types of Hybrid/Balanced Funds

In some classifications, balanced mutual funds are known as hybrid funds while in others, they are classified as a type of hybrid funds. The other types of hybrid funds are Monthly Income Plans (MIPs) and Arbitrage funds. For the purpose of understanding, let’s look at different types of hybrid/balanced funds available in the market.

a. Equity Oriented Balanced Funds

In the normal jargon, a balanced fund refers to the funds where 65% or more of the fund is invested in equity. As explained above, the equity orientation is more than being just a 50:50 break-up of funds between equity and debt.

b. Monthly Investment Plan (MIP)

Whereas balanced funds are generally biased towards stocks, MIPs are focused on fixed income instruments or bonds. While up to 65% of the assets of a balanced fund are invested in stocks, MIPs invest only about 20-35% of their assets in equities, sometimes even less. They try to outdo their debt mutual fund peers by having this equity exposure. MIPs are dividend-paying instruments where an investor can choose the periodicity of payments between monthly, quarterly, half-yearly or annually. MIPs also offer growth plans. These are also termed as debt-oriented Balanced Funds many times

c. Arbitrage Funds

Apart from balanced funds and MIPs, there are Arbitrage Funds. These are equity-oriented mutual funds that use the arbitrage strategy, which intends to benefit from the spread between spot and future prices of stocks in the cash and the derivatives market. The fund manager actively looks for profit opportunities arising from this difference in pricing between two markets. In case no such opportunities are available, arbitrage funds tend to invest in the money market instruments or cash and cash equivalents.

List of Top Balanced Funds in India

| Mutual Fund Scheme Name | Returns | ||

| 1 Year | 3 Years | 5 Years | |

| HDFC Hybrid Equity Fund-Direct (G) | 3.80% | 12.80% | 20.40% |

| Reliance Equity Hybrid Fund – Direct (G) | 4.50% | 13.50% | 19.50% |

| ICICI Prudential Equity & Debt Fund – Direct (G) | 7.70% | 14.50% | 19.40% |

| Principal Hybrid Equity Fund-Direct (G) | 7.60% | 17.20% | 19.30% |

| L&T India Hybrid Equity Fund-Direct (G) | 2.70% | 11.80% | 19.30% |

There are various measures to assess which mutual fund is the best in its category. One can look at simple returns, rolling returns, risk-adjusted measures, standard deviation, and other metrics and ratios to arrive at their favored list. The following list compiles the best performing balanced funds in India based on performance over five years as of September 20, 2018.

Benefits of Balanced Mutual Funds

The biggest benefit provided by balanced funds is that of diversification. By investing in a single scheme an investor can diversify his investment into stocks and bonds. The selection of these stocks and bonds is in the hands of a professionally qualified and experienced fund manager who is expected to a better job than an untrained investor.

This diversification benefit is excellent for protecting the investment against market volatility. While the equity component is of immense benefit when markets are rising, its smaller exposure compared to an equity mutual fund helps contain the damage when markets are falling. The same is the case with the debt component which benefits the fund when bonds are gaining and also cushions the blow when equity markets are on the decline.

It is important to note, though, that similar to any security investing in financial markets, balanced funds do not guarantee any return and investors should be cautious of any such information about guaranteed returns. Also, a medium-term investment horizon of 3-5 years is required for balanced funds to yield expected results.

Who should Invest in Balanced Funds?

Balanced funds are a good choice for those investors who are new to mutual funds. Given their relative conservative nature as compared to full-fledged equity mutual funds, they can be a comfortable starting point for those investors new to funds as investing in equities does not come naturally to most investors.

Among more seasoned investors who have experienced the benefits of mutual fund investing before, balanced funds are suited for those who are risk-averse. Such conservative investors, by investing in balanced funds, can reduce their investment risk profile but still have enough exposure to equities to benefit from them during rising markets.

Meanwhile, during declining markets, the lower exposure to stocks would help contain the decline. Balanced funds can be useful for those investors who have an investment horizon of three to five years.

Another category of investors that can find balanced funds useful is those who invest in mutual funds only for debt funds. Some exposure to balanced funds can help them benefit from the asset class and add another dimension to their portfolio.

Taxation of Balanced Funds

| Type of Balanced Fund | Short -Term Capital Gains Tax | Long-Term Capital Gains Tax |

| Equity Oriented | 15% (within 1 year) | 10% in capital gains > Rs 1 Lakh |

| MIP/Debt Oriented | Per Tax Slab (within 3 years) | 20% with Indexation + 3% cess |

| Arbitrage | Same as Equity Oriented | Same as Equity Oriented |

Since balanced funds are equity-oriented, they are taxed like equity funds. While short-term capital gains, i.e. gains realized within one year of investment, are taxed at 15%, long-term capital gains, i.e. realized gains beyond 12 months of investment, are taxed at 10% if the capital gains exceed Rs 1 lakh in a financial year.

We have looked at types of hybrid/balanced funds. Now let’s look at how they are taxed as well. Since MIPs are debt oriented mutual funds, they are taxed like debt funds as well. Gains realized within three years of investment are considered as short-term added to the individual’s annual income and taxed according to their taxable income slab. Meanwhile, gains realized after 36 months of investment are considered long-term and are taxed at the rate of 20% with indexation plus 3% cess.

For taxation purposes, arbitrage funds are considered as equity funds and taxed accordingly as highlighted above.

How to Invest in Balanced Funds?

In order to invest in balanced funds, an investor can approach the fund company directly, use an online brokerage or application which facilitates mutual fund investments, or employ the services of an investment advisor.

Some common information to be made available regardless of the mode chosen from the list given above would be the investment amount, whether it would be a lump sum investment or a Systematic Investment Plan (SIP). Then a KYC check would be done, and once completed, an investor can choose the fund(s) they want to invest in.

No Comments