Union Budget 2019

The Balancing Act: Short term pain for Long term gain

As the dust settles on the Lok Sabha elections with the Modi Government returning with a bang on the back of thumping majority, all eyes were on the Budget, as a medicine to revive growth in the economy. At a time when India is facing a lower growth environment along with a lower global growth, markets were expecting a strong dose from the Finance Minister Mrs. Nirmala Sitharaman. However, the Budget stayed away from any big bang reforms and stuck to the playbook of Modi 1.0, maintaining the glide path of fiscal prudence and spending on social equality. Though the budget had nothing specific to cheer about for the investor community either by way of some tax incentives or by way of any reforms that could have driven short term positive sentiments, the Budget focused on long term reforms related to fiscal prudence, social spending and better tax compliance.

Below are some of the key takeaways from the Budget

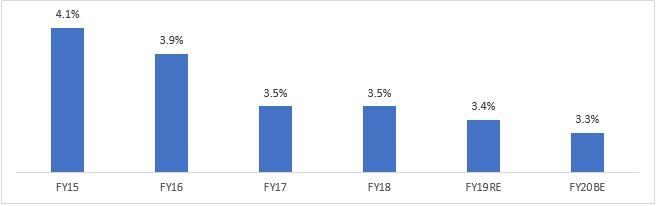

- Lowered Fiscal Deficit target for FY20 to 3.3%

The interim Budget had pegged the fiscal deficit target at 3.4% and the market were expecting the deficit to be in the range of 3.5% to 3.6% in order to accommodate growth concerns. However, the Finance Minister surprised everyone by pegging the deficit target to 3.3%. While this move is positive as it shows the government’s commitment to stay on the fiscal prudence glide path, it is quite likely that the deficit will be achieved by curtailing expenditure which is not a positive sign for the economy in the short term.

Below are some details on the fiscal maths:

a) Government has continued its efforts on fiscal prudence by targeting lower fiscal deficit

Source: Budget documents, MOSPI

b) Tax revenue growth seems modest. Higher growth expected in Customs and Excise mainly on account of higher excise duty on petrol/diesel and increase in custom duties on imports to encourage domestic manufacturing

YoY growth

| Particulars | FY17 | FY18 | FY19RE | FY20BE |

| Corporate Tax | 7.0% | 17.8% | 17.5% | 14.2% |

| Income Tax | 26.8% | 18.1% | 22.8% | 7.6% |

| Customs | 7.1% | (42.7%) | 0.8% | 19.9% |

| Excise Duties | 32.6% | (32.1%) | 0.1% | 15.6% |

| Net Tax Revenue | 16.7% | 12.8% | 19.5% | 11.1% |

Source: Budget documents

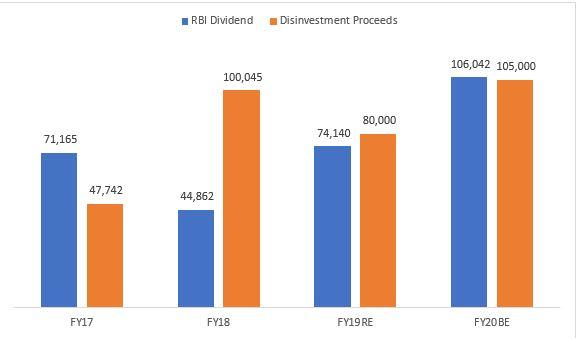

c) Higher reliance on non-tax revenues (can expect slippages if not achieved).

Amt in Rs Crores

Source: Budget documents

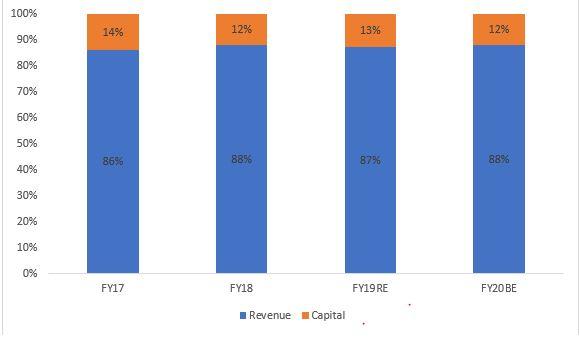

d) The quality of expenditure has deteriorated with higher revenue expenditure forming part of overall budget expenditure

Source: Budget documents

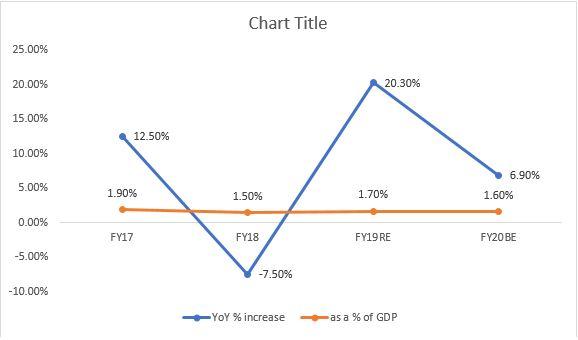

e) No major rise in Capital expenditure allocation

Source: Budget documents, MOSPI

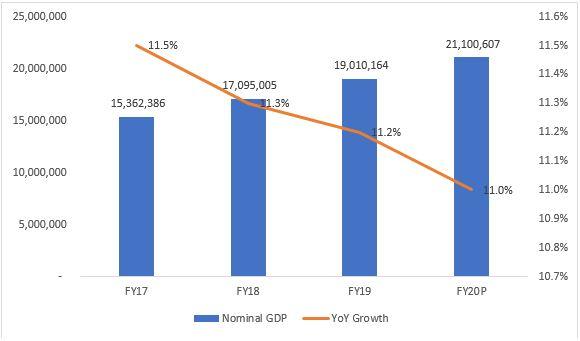

f) Lack of growth momentum may hamper the fiscal maths

Source: Budget documents, MOSPI

2. (T)Axing the Super-rich

In order to garner additional tax revenue and to compensate for the tax foregone from taxpayers having total income of up to INR 5 lacs, the Finance Minister increased the surcharge to 25% and 37% for those earning income between INR 2 – 5 crore and INR 5 crore and above respectively. This is not a great move as instead of increasing the tax base to garner revenue, the budget is further taxing those taxpayers who already pay the highest tax rate in the country. As per Income tax records as on March 2019, there are around 1 lac individuals who file return with income above INR 1 crore. Following is the illustration on the impact of this increase in surcharge.

| Particulars | Pre Budget | After Budget 2019 | Pre Budget | After Budget 2019 |

| Income (INR) | 35,000,000 | 35,000,000 | 55,000,000 | 55,000,000 |

| Tax (INR) | 10,312,500 | 10,312,500 | 16,312,500 | 16,312,500 |

| Applicable Surcharge | 15% | 25% | 15% | 37% |

| Surcharge Amount (INR) | 1,546,875 | 2,578,125 | 2,446,875 | 6,035,625 |

| Total Tax (INR) | 11,859,375 | 12,890,625 | 18,759,375 | 22,348,125 |

| Cess (INR) | 474,375 | 515,625 | 750,375 | 893,925 |

| Tax Payable (INR) | 12,333,750 | 13,406,250 | 19,509,750 | 23,242,050 |

| Extra tax payable (INR) | 1,072,500 | 3,732,300 | ||

| Effective Tax Rate | 35.2% | 38.3% | 35.5% | 42.3% |

Source: Budget documents

3. Increase the minimum public shareholding threshold in listed companies from the existing 25% to 35%

The Finance Minister has proposed to increase the minimum public shareholding threshold to 35% from the current level of 25% in listed companies. The proposal will be discussed with SEBI before implementation and hence there is no clarity on the timeline. The proposal may help in increasing retail participation in equity markets. It may however be negative in the short term as it indicates additional supply that will hit the market in order to meet the revised promoter holding limit. This move will be long term positive in the International markets as major global indices allocate weights based on free float capitalization and with a higher free float, India will be able to attract more foreign capital. A study of the top 500 companies reveals that ~ INR 3.5 lac crore of amount will be offloaded and around 15companies contribute 50% to the overall amount. Below is an indicative list of companies with an expected offload amount.

Amt in crs

| Company Name | Mcap | Promoter % Holding | Dilution | Expected Offload | % of TOTAL |

| Tata Consultancy Services Ltd. | 816,556 | 72% | 7% | 57,567 | 16.2% |

| Wipro Ltd. | 161,174 | 74% | 9% | 14,264 | 4.0% |

| Avenue Supermarts Ltd. | 86,685 | 81% | 16% | 14,043 | 4.0% |

| Bandhan Bank Ltd. | 63,514 | 82% | 17% | 10,963 | 3.1% |

| HDFC Life Insurance Co Ltd | 93,400 | 76% | 11% | 10,405 | 2.9% |

| IDBI Bank Ltd. | 26,535 | 97% | 32% | 8,613 | 2.4% |

| Coal India Ltd. | 143,253 | 71% | 6% | 8,538 | 2.4% |

| Hindustan Unilever Ltd. | 379,555 | 67% | 2% | 8,312 | 2.3% |

| General Insurance Corporation of India Ltd. | 39,649 | 86% | 21% | 8,239 | 2.3% |

| HDFC Asset Management Company Ltd. | 40,469 | 83% | 18% | 7,171 | 2.0% |

| Bank of India | 27,723 | 87% | 22% | 6,113 | 1.7% |

| Interglobe Aviation Ltd. | 60,401 | 75% | 10% | 5,998 | 1.7% |

| Hindustan Aeronautics Ltd. | 22,611 | 90% | 25% | 5,646 | 1.6% |

| ICICI Prudential Life Insurance Company Ltd. | 54,756 | 75% | 10% | 5,465 | 1.5% |

| The New India Assurance Co. Ltd. | 23,838 | 85% | 20% | 4,873 | 1.4% |

| Corporation Bank | 16,904 | 94% | 29% | 4,818 | 1.4% |

| TOTAL | 355,467 |

Source: ACE Equity

4. The budget proposes to extend buyback tax at 20% to listed companies as well. This is to discourage the practice of listed companies avoiding Dividend Distribution Tax (DDT) through share buybacks

5. Companies having an annual turnover of up to INR 400 crs are now liable to pay 25% tax. Earlier the limit was INR 250 crs.

6. In order to revive the financial sector, the Government will provide INR 70,000 crs recapitalization to public sector banks to boost credit growth.

7. The Government will also provide a first-loss credit guarantee of up to 10% to PSUs for purchase of high-rated pooled assets from NBFC. This move will help in providing some liquidity to NBFCs which are currently facing a liquidity crunch

8. Additional interest deduction of INR 1,50,000 will be provided on home loans availed for a house valued up to INR 45 lacs, in order to boost affordable housing. This is in addition to the existing deduction of INR 2,00,000.

9. In order to attract foreign capital, the Government will examine to open further FDI limits in aviation, media and insurance sectors. Also, local sourcing norms will be eased for FDI in single-brand retail sector.

10. In order to take advantage of global liquidity and prevent a crowding out effect in the domestic borrowing markets, the Government will try to tap overseas borrowing to finance its fiscal deficit.

11. Housing Finance Companies (HFCs) will be brought under the regulation of Reserve Bank of India (RBI) from the earlier National Housing Board (NHB)

Watch Orowealth Research and Advisory team decoding the Budget here: https://www.youtube.com/watch?v=iCvb8eJvlM0

Outlook

The equity markets are disappointed in the absence of any big bang reforms. Over reliance on non-tax revenue and lack of a boost to capex will lead to a disappointment among market participants. The overall profitability of Indian companies is yet to pick up and with liquidity crunch faced by NBFCs, growth outlook seems lower in the near term.

However, if the Government succeeds in the execution of its long-term reforms, India can attract large amounts of high-quality capital which will not only boost sentiments but also prop up the equity markets. Issues related to liquidity crunch, projects on hold for approval, better infrastructure etc. also need to be addressed on priority. From a longer-term perspective, all the measures will help in structural development and thus equity investments will be rewarded over a 3 – 5 year horizon. For now, it’s best to stay invested in Equities via SIPs (or in select high quality companies) and not aggressively purchase at current levels in the hope of a short-term upswing.

W.r.t. the debt markets, after a series of rate cuts, plus with no major increase in domestic market borrowings, and with a proposal to tap overseas borrowing, we expect debt yields to be contained at lower levels and this asset class will reward its investors. With inflation and fiscal deficit contained, an accommodative stance will be adopted by RBI and may even lead to a few more rate cuts. Thus, one can build some exposure to long term gilts in their portfolio.

Bhupender Bharti

Posted at 19:02h, 11 JulyUseful information