Rupee Cost Averaging in SIP

One of the main objectives of investing is long-term profit maximization. You would hear this from a lot of advisors. But have you ever wondered how it is achieved?

The capital appreciation that an investor seeks to generate doesn’t come overnight and neither is it achieved with one instrument by investing one time.

So what should be the approach?

We believe wealth creation is a steady process and an investor should look for diversification, systematic investment and patience with a long-term investment horizon.

This brings us to introduce you to two things – Mutual Funds and Systematic Investment Plan.

Let us begin with the former –

What are Mutual funds?

Mutual funds, as many of you are aware, is a collection or portfolio of securities and currently is one of the most rapidly growing investment instrument. A mutual fund provides benefits such as diversification by investing in multiple securities/asset class/instruments and other benefits such as flexibility of investment, liquidity, superior returns beating the inflation, and expert management.

What is Systematic Investment Plan or SIP?

In a SIP, an investor invests a specific amount at regular intervals irrespective of the assets’ per unit price.

For example, if you start a SIP in a fund on 7th of every month of Rs 2500 per month, this amount will be debited from your bank and will be invested in the fund irrespective of the unit price of the fund that could be either high or low. Does it help to invest regularly without seeing the price?

This method of investing is one of the most popular ways of investing in mutual funds. By investing regularly, an investor takes the benefit of investing across market (both up-market and down-market). This results in rupee-cost averaging. Rupee cost averaging – a concept that is related to SIP. This shall help you understand why systematic investment is the best-suited method for investing.

What is Rupee Cost Averaging?

Rupee Cost Averaging is an investment strategy that is applicable to systematic fixed investments in mutual fund schemes. As the investment amount is regular and fixed, an investor buys fewer units of the mutual fund scheme(s) when the market price of shares is high and buys more units when the market price low. This investment strategy helps in spreading out the risk associated with investing in the market.

Rupee Cost Averaging in Mutual Funds Investment

Before we show some calculation of rupee cost averaging, let us highlight its characteristics.

• Rupee cost averaging suits those who do not have time to monitor the market

• In rupee cost averaging you invest a fixed amount at a fixed interval irrespective of the price of the unit

Let us now see the following example. Assume you start investing in a fund. You start a monthly SIP of Rs 10000 for six months.

| Month | Amount invested | Cumulative investment | Per unit price | # of units | Cumulative units | Average cost |

| Jan-18 | 10000 | 10000 | 25.0 | 400.0 | 400.0 | 25.0 |

| Feb-18 | 10000 | 20000 | 26.0 | 384.6 | 784.6 | 25.5 |

| Mar-18 | 10000 | 30000 | 25.5 | 392.2 | 1176.8 | 25.5 |

| Apr-18 | 10000 | 40000 | 24.0 | 416.7 | 1593.4 | 25.1 |

| May-18 | 10000 | 50000 | 23.5 | 425.5 | 2019.0 | 24.8 |

| Jun-18 | 10000 | 60000 | 25.0 | 400.0 | 2419.0 | 24.8 |

Now see a couple of things –

If you invest entire Rs 60000 in say Jan 2018, you will get 2400 shares as compared to 2419 shares you got by investing systematically. Similarly. If you see the average cost of buying comes down to Rs 24.8 per unit if you invest regularly.

Thus, the reduction of the cost of investing is rupee cost averaging.

Benefits of Rupee cost averaging

• An essential tool that helps an investor get maximum value for invested money

• Used for hedging if the market is moving down

• There is no need for daily market tracking

• Balances the volatility associated with the market

• Flexible and offers a better opportunity for wealth creation

Now the question is, will rupee cost averaging make you rich?

Before we answer it, let us show you some numbers.

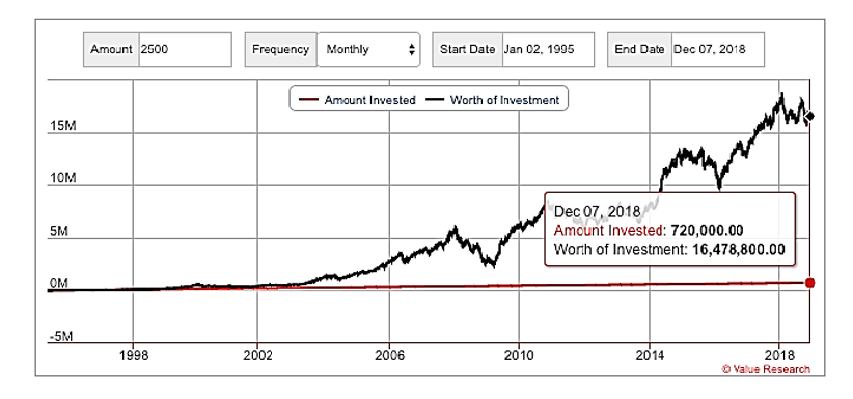

Source: Valueresearch Online

Let us talk about HDFC Equity Fund – one of the oldest funds in India that was launched in 1995. Assume you had a SIP since the launch of Rs 2500 monthly. As of December 7, 2018, the value of the wealth would have been Rs 1,64,78,800. If you notice your investment amount, it is Rs 7,20,000.

Thus, you get nearly 22-23x wealth which is likely 1x every year.

If you carefully notice the graph, you would see both the fund value and investment amount nearly coinciding until 2003. Post-2003, the wealth starts to build up, and you could see the delta building up.

As we saw in the above example, regular investments over a long period have historically provided to accumulate sizeable wealth at a healthy growth rate.

Thus, it is crystal clear that SIPs are successful in increasing your health. Remember the compound interest concept you would have heard in your high school days? SIP is based on that concept.

The concept says that if you remain invested for long-term (years after years), you earn interest on principal and interest both.

• The first-year – You earn interest I1 on principal P0.

• The second year – you earn interest I2 on principal P1. In this case, P1 is P0+I1

• The third-year – You earn interest on principal P2 which is P1+I2

So, if you notice your principal amount starts increasing after the first year. The interest on the principal also begins fetching additional interest.

Thus, as you remain invested for long-term, not only your principal but your interest accumulated over time starts generating additional interest. This method is compounding.

How to implement?

The best way to implement is to start with goal based investing. The power of compounding and rupee cost averaging is best seen when you use a goal-based approach. For example, assume you need to plan for your house down payment or maybe your children’s marriage or your children’s education. Start investing separately for each of these goals. For more understanding on goal-based investing, check out Orowealth blog. Alternatively, you can browse through Orowealth calculator to play around with the numbers.

Conclusion

Let us now conclude and say that compounding, per Albert Einstein, is the eighth wonder of the world. If you get its benefit, you are the winner else you pay off. So, remember you need to remain invested for a long time and not only stay invested but continue your investments regularly. This way you get both compounding and also rupee cost averaging and eventually you come out with a massive amount of wealth.

Nirmal Singh

Posted at 16:49h, 29 DecemberVery nice, useful, neutral & authentic information