KYC status on Mutual Funds

What is KYC?

KYC stands for Know Your Customer, a process involving identifying and verification of customers by a bank or any financial institution. It is a mandatory process as per the RBI norms to have their customers KYC process completed before allowing them to have complete access to their services or making any transaction.

Why KYC is necessary?

According to the Prevention of Money Laundering Act, 2002, from July 1, 2005, KYC is done as a precaution against illegal activities like bribery, money laundering or corruption. It also helps the government to keep track of activities beforehand. Thus, SEBI also mandated that all intermediaries (including Mutual Funds) should formulate and implement a proper policy framework as per the guidelines. It also helps the customer to gain access to many of the company’s premium products and get transactions done faster.

SEBI and AMFI from 2012 made KYC mandatory for those who want to invest in mutual funds. Prior to that one had to submit his PAN card if he has to invest more than Rs 50,000 in mutual funds.

What does KYC Status mean?

One can check their KYC status using either PAN card or Aadhaar card on most of the websites. If one has undergone Aadhaar based KYC registration, then they can check their KYC status by entering their UIDAI number. The same procedure can be done for PAN-based registration by putting PAN number.

There are five KYC Registration Agencies (KRAs) in place to help investors:

● CAMS KRA

● CVL KRA

● NSE KRA

● NSDL KRA

KYC status can be any one of the below five stages:

● KYC Registered:

The records are successfully registered with the KRA.

● KYC Under Process

The KYC process is being accepted by the KRA and it is under process.

● KYC On-hold

The KYC process is on hold due to the discrepancy in the KYC documents. The documents that are incorrect need to be re-submitted.

● KYC Rejected

The KYC has been rejected by the KRA after verification of PAN with other KRAs. This means that your PAN is available with other KRA.

● Not Available

The KYC record is not available in any KRAs.

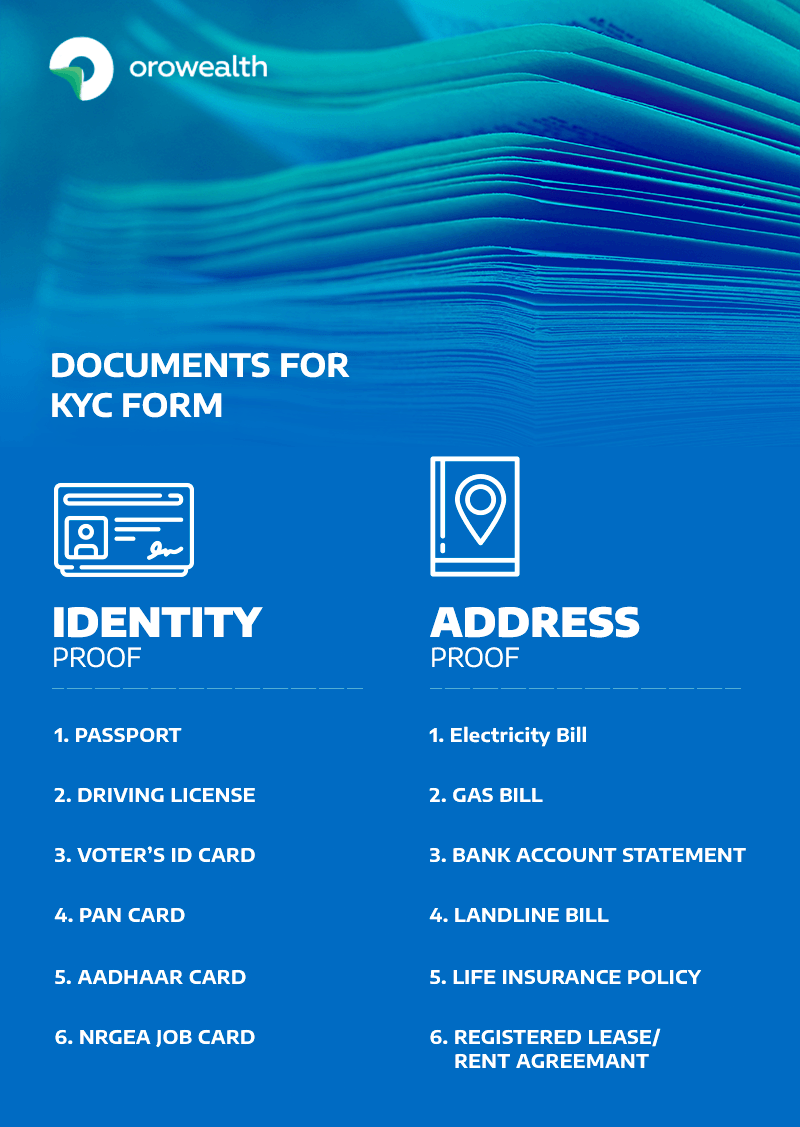

Documents required for KYC

Along with the KYC form, an investor has to produce documents for verification of his Identity and his address.

Below is a list of documents that can be submitted as proof of identity

● Passport

● Driving Licence

● Voters’ Identity Card

● PAN Card

● Aadhaar Card issued by UIDAI

● NREGA Card

If any of the above documents contains the address, it will be accepted as an address proof document as well or one has to submit any one of the below-listed documents.

● Landline bill

● Electricity bill

● Passport

● Demat account statement

● Latest bank passbook

● Ration card

● Voter ID

● Rental agreement

● Driving License

● Aadhaar card

Many banks and financial institutions ask individuals to self attest before submitting and it should be accompanied by the original documents for verification. If needed, it should be properly attested by entities authorized for attesting documents.

Steps for doing KYC

● The KYC application form is available at the investor service centers of the Fund and CAMS or at any designated ‘Points of Service’ (POS) of CDSL Ventures Ltd. or can be downloaded from your broker, Advisor or AMC. You can also download it from here (KYC Form Individual / KYC Form-Non-Individual).

● Produce the original required documents while submitting the form.

● The investor also has to submit an IPV (In-person verification).

● Submit the KYC to the nearest intermediaries of KRA or the POS.

● Check your KYC status on any of the KRA by providing your PAN card number to see if any issue, else KYC status should show complete or registered.

The above-mentioned process is the regular KYC process i.e. PAN-based KYC or CKYC. CKYC compliance will allow an investor to transact/deal with all entities governed/regulated by Government of India / Regulator (RBI, SEBI, IRDA, and PFRDA) without the need to complete multiple KYC formalities. It also allows for larger market participation by investors. CKYC processing is handled by CERSAI.

About KYC Norm

KYC is an important process to identify and verify any investor. So, to make the process easier for investor CKYC came into place. Now, the investor does not have to do multiple KYC processes.

Central Registry of Securitization Asset Reconstruction and Security Interest (CERSAI) is a central online security interest registry of India authorized by the Government of India to act as and to perform the functions of the Central KYC Records Registry under the PMLA (Prevention of Money-Laundering) rules 2005, including receiving, storing, safeguarding and retrieving the KYC records in the digital form for a client.

Prior to this, as there was no uniformity in the KYC processes between different SEBI registered intermediaries like Mutual Funds, Portfolio Managers, Venture Capital Funds, and Collective Investment Schemes. SEBI introduced the KYC Registration Agency (KRA) to bring the uniformity.

About KRA

KRA or KYC Registration Agency is a SEBI registered agency, that maintains the KYC records of the investors centrally, on behalf of capital market institutions complying with SEBI. KRA is registered with SEBI under the KYC Regulations Act of 2011. KRA allows the investors to invest in multiple Mutual Fund schemes of different Asset Management Companies (AMCs) without repeating the same KYC process for each AMC. The records of the completed KYC process are stored centrally by the KRA and can be accessed by other intermediaries in the market and KYC registration agencies. Also, any changes that might occur in the future are also updated on a central server. This can be initiated by giving a simple request to the KRA through any registered intermediary.

For any issues related to mutual funds and KYC, please visit https://www.orowealth.com/

ELANKATHIR SELVAN N

Posted at 09:53h, 10 AprilPlz help me to find out good performing funds

Gaurav Chakraborty

Posted at 05:29h, 11 AprilHello Elankathir, There are multiple things we have to check before suggesting you any funds, so request you to please reach us at connect@orowealth.com or call us at +919167451886. We will be more than happy to help you.

arun ramasamy

Posted at 02:18h, 29 AprilI have applied kyc one month back..but appl.status shows response received….in kyc status it shows registered…but I didn’t get ckyc ID…wat to do? Can I proceed with investment ? Without ID wat to do for reference of investment?

Gaurav Chakraborty

Posted at 12:51h, 29 AprilHello Arun, I request you to please reach us on +91-9167451886 or drop a mail at connect@orowealth.com so we can assist you with this.