International mutual funds: An in-depth look.

When Indian investors want to diversify globally, investing in international mutual funds domiciled-in-India is the default option available. In this blog, I look at these funds as a whole before I split the 36 available funds into 9 categories and then study each category in more detail. For an even more in-depth look at each fund, you can download an excel file capturing essential details on them.

Few facts about the international funds domiciled in India.

Choice of funds

There are just 36 funds in all. Given that these funds represent are supposed to represent the gamut of opportunities worldwide, it is a very tiny menu indeed! A quick breakup is as follows.

Feeder funds vs. Direct funds

Most funds invest through an underlying fund. Out of 36 funds, only 7 funds directly invest in equities while the rest piggybank on an existing fund from their own AMC house or another. E.g. the ICICI Prudential US Bluechip Fund invests directly while a fund like DSP US Flexible Equity Fund – Direct Plan is actually a feeder fund and invests almost all its funds into BlackRock Global Funds – US Flexible Equity Fund I2 USD.

Ease of investing

You can invest in these funds as easily as you invest in any domestic fund. This can be done either through the AMC website or through any mutual funds aggregators (ET money, Paytm money, Zerodha, etc.).

Fund size

Only 1 fund (Franklin India Feeder Franklin US Opportunities Fund) is close to an AUM of 1000 cr yet. Out of the remaining, only 5 funds have an AUM in excess of 100 cr. Clearly, investing in international funds in India is still a niche practice.

Expense ratios

In general, the distribution of fees across these funds is on the higher side with 2 funds even carrying fees in excess of 2%!

- <=0.5% – 5

- >0.5% <=1% – 11

- >1% and <= 1.5% – 6

- >1.5% and

- <=2% – 9 >2% – 2

Taxation

International funds are taxed as debt funds unless they invest at least 65% of their portfolios in Indian equity instruments. When treated as debt funds, short-term capital gains are taxed at the investor’s marginal rate of tax and long-term capital gains on investments held for more than 36 months are taxed at 20% with indexation benefits.

Key issues to keep in mind when investing

Small fund size => poor attention by the fund manager?

International funds invariably suffer from very small AUM sizes. As mentioned, even the largest one is still a shade below 1000 crores. A key question that comes to mind then is how much attention these funds get from their respective fund managers.

Assume a fund size of 100 crores and an expense ratio of 1.5%. This means a gross revenue for the AMC of only 1.5 crores. If it is a 300 crores fund instead, gross revenue is 4.5 crores. From this, the AMC needs to pay salaries to the fund manager and his research team + other overheads.

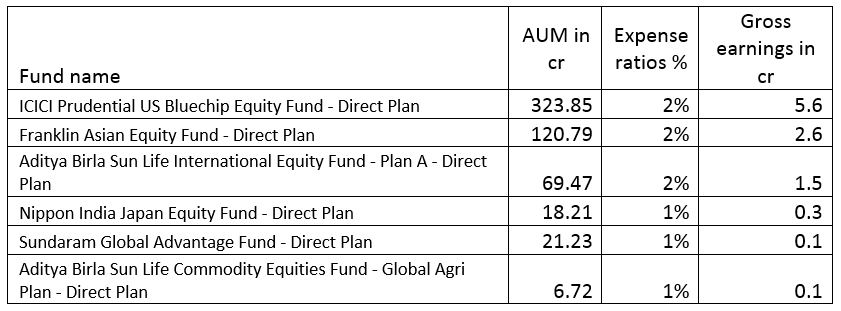

From this perspective, it appears to be a good strategy that most of the funds are feeder funds, investing mostly through underlying funds. What about the 6 funds which invest directly in foreign securities? The table below lists these funds.

As you can see, 3 of these funds do not even earn a crore in gross earnings in a year. How much is the fund manager likely to invest his time in these funds?

The mystery of expense ratios for feeder international funds.

One subject I am not clear about is whether the declared expense ratios of the feeder funds include the expense ratios that the underlying funds charge. I have not been able to find a clear answer to this issue but my sense is that those investing in such funds are being ultimately charged for both without letting them know this explicitly.

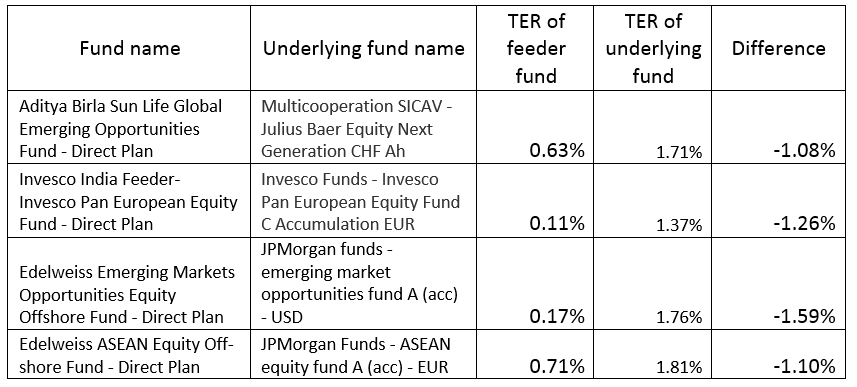

Look at the following table.

As you can see, the underlying fund has higher fees than that declared by the feeder fund – the difference is atleast 1% which the latter certainly cannot be paying from their own pockets. The only option I can see is that the feeder funds are charging their fee over and above the fee of the underlying fund.

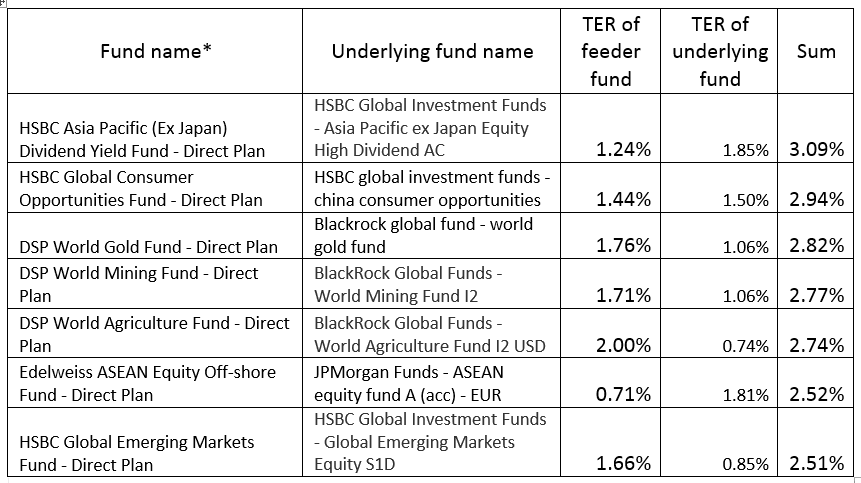

If they are doing that, there is another issue, however. Some of them are running afoul of a SEBI proposal (clause 5.5.2.1) basis which total expense ratio (i.e. TER) for feeder funds investing in equity funds is capped at 2.25%. For e.g., look at this table below where the total of the fees charged by the feeder fund and underlying fund easily exceeds 2.25%.

The only explanation could be that SEBI proposal has just remained a proposal and the feeder funds are actually charging both the fee to the investor while conveniently declaring only the fees charged by them. If this is true, most international funds become quite expensive from a fee point of view.

Am I sure about it? No. Hopefully, you can tell me better.

Fund comparison

A quick comparison of the various funds follows while splitting them into relevant categories. Please note that I have avoided making any fund recommendation; you can make your own decisions.

How to read the tables below?

Please note that given that most funds are feeder funds, the asterisks on the column headings in the tables below indicate a reference to the feeder fund while the other columns primarily refer to the underlying fund.

A quick reminder on how to read the morningstar ratings; the numerical ratings refer to the past performance while gold/silver/ bronze / neutral refers to future prospects of the fund.

A link at the bottom of the post leads to an excel download which gives more details on each of the funds,

- Fund managers details

- Benchmarks which each fund tries to match up or emulate

- Portfolio details

- Past performance over various time horizons

- Links to both the feeder fund & underlying fund websites & to the underlying fund’s morningstar pages. I have tried to ensure that the links point to the same share class as the feeder fund invests in. These links should help in doing more detailed research.

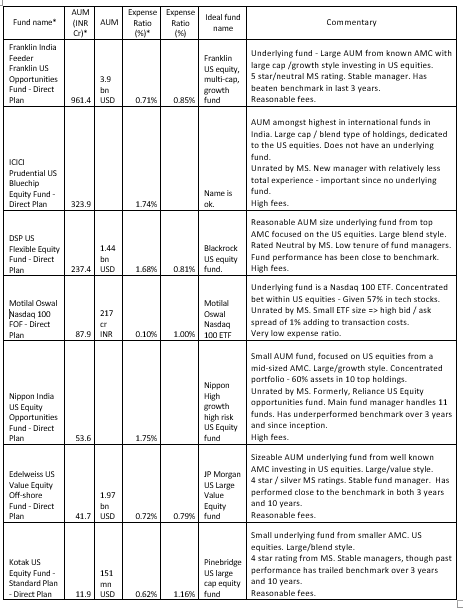

US funds

There are 7 funds to choose from in this category. All have a large cap bias including the one which invests in NASDAQ 100. One fund has a 5 star and two have 4 star ratings.

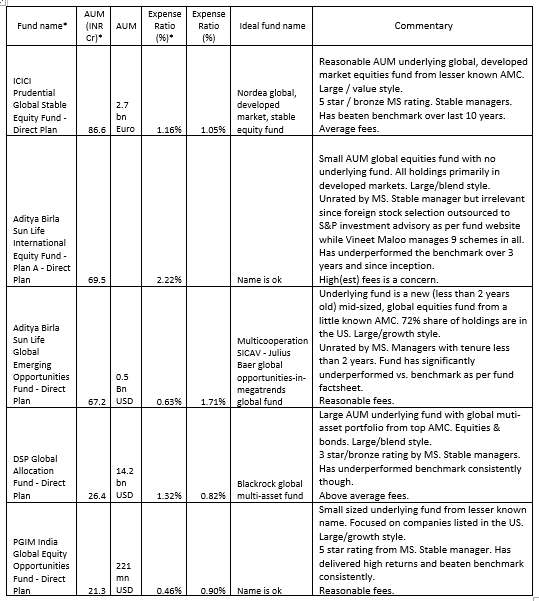

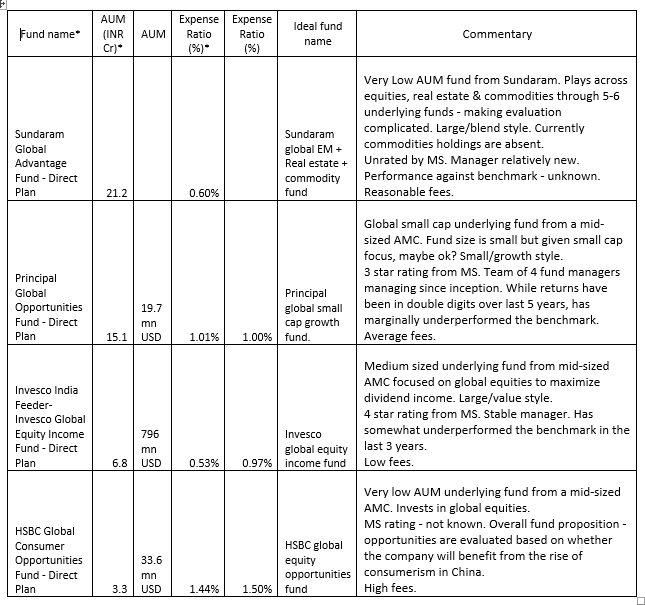

Global funds

There are a total 9 funds. All have a large cap bias except for one small cap fund. Further, two funds invest in equities and also other assets classes. One fund focuses on dividend income from equities. 1 fund with 5 star rating and 2 with 4 star rating from MS.

I have divided the 9 funds into two tables only for the purposes of improving the readability of the tables.

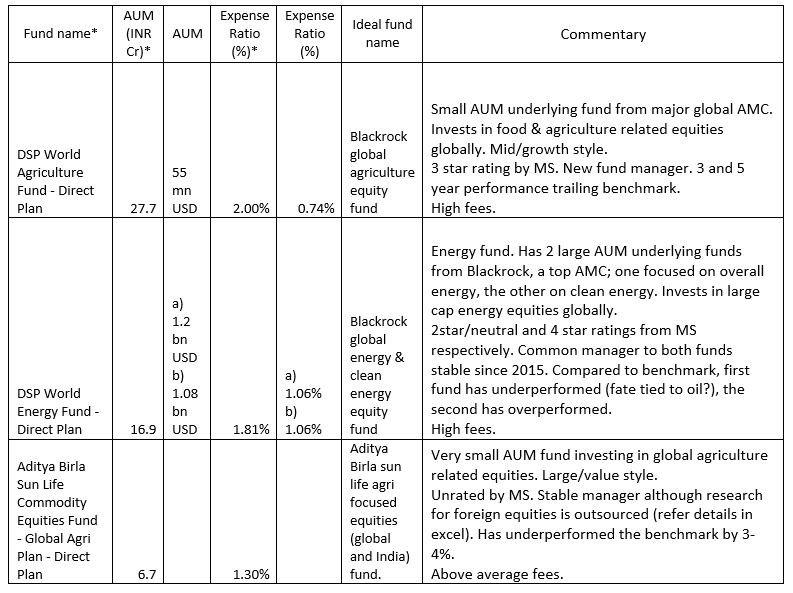

Commodity funds

There are two funds focused on agri sector while one is focused on energy (an interesting combination of two underlying funds – overall energy and clean energy). Incidentally, the two agri funds have different styles – one has a mid-cap / growth bias, while the other has a large cap / value focus. Do make a note of the extremely small AUM of the ABSL fund.

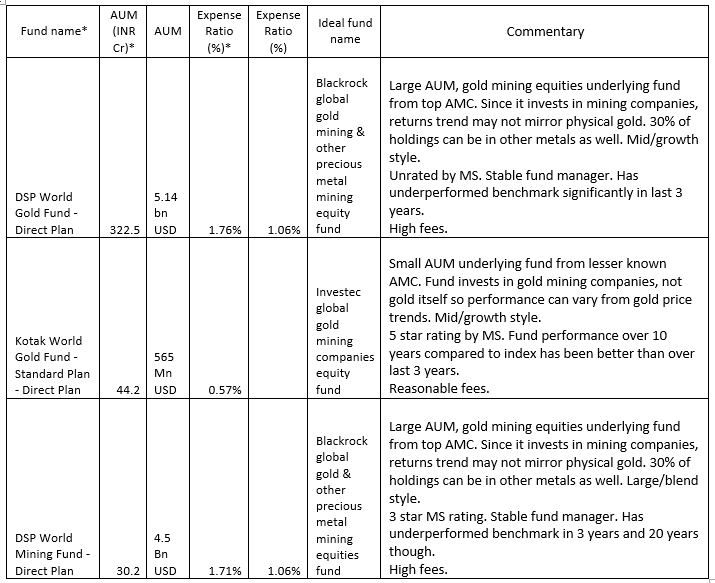

Gold/precious metal funds

All 3 invest in companies mining gold (and/or other precious metals). Includes one fund with a 5 star rating from MS.

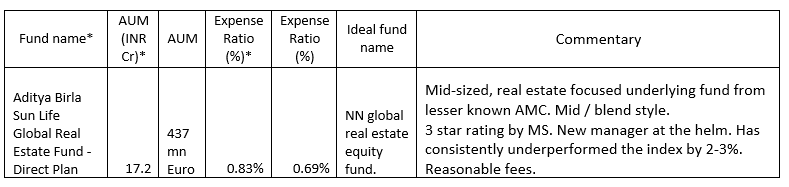

Real estate fund

Emerging markets funds

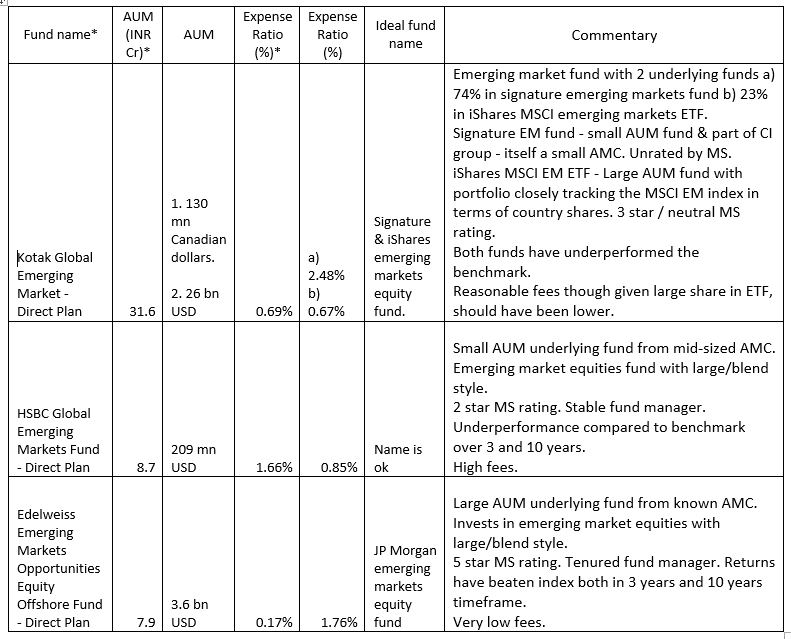

The first fund has two underlying funds. 1 out of the 3 has a 5 star MS rating.

Europe funds

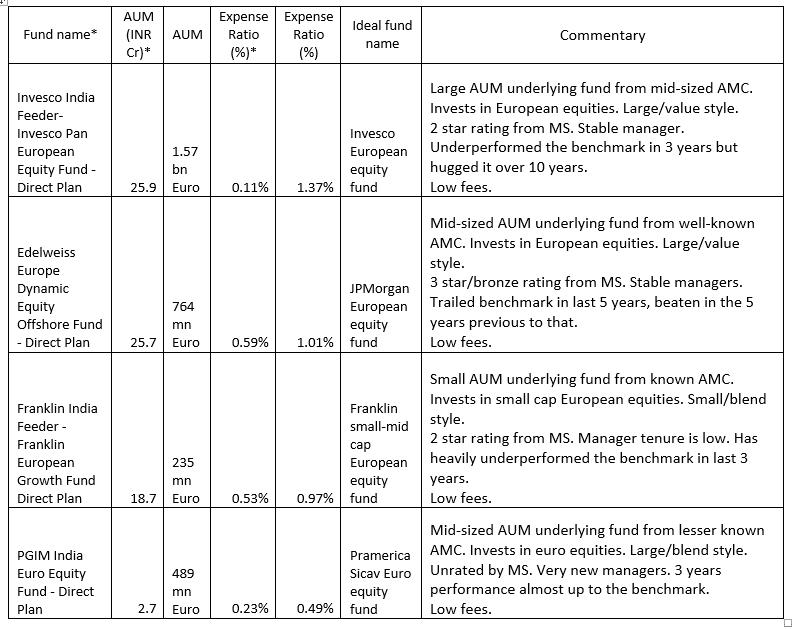

4 funds – except for one small / mid cap style fund, all others have a large cap bias. None have good ratings from MS.

Asia funds

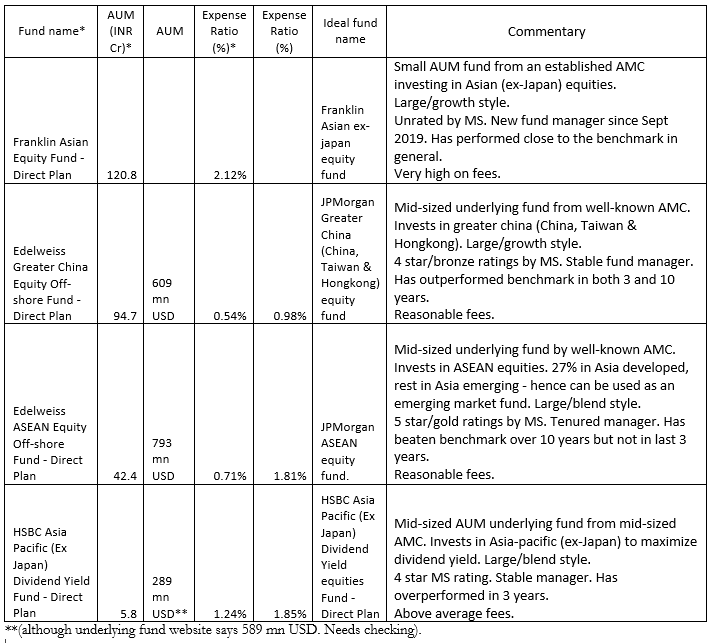

4 funds all investing with a bias for large cap equities – one of these has a dividend yield maximization goal. Further, 1 fund has 5 star / gold rating while two others have 4 star ratings from MS.

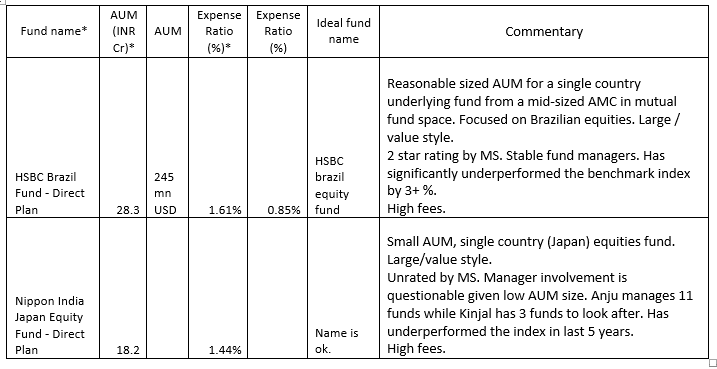

Single country funds

1 Brazil and Japan focused fund each.

Final comments

There you go 36 funds, spread across 9 categories. Hopefully, this helps you to decide whether you want to invest in international funds and if yes, which ones to put your hard-earned money into.

Global diversification series

This blog post is the second part of a series on global diversification for Indian investors. You can read the other posts in this series below.

- First post: Why-global-diversification-is-a-must-for-indian-investors

- Third post: Investing-through-us-markets-to-achieve-global-diversification

Source: WithOnionAndGarlic

Disclaimer: The above facts are basis my own research around the beginning of Nov 2019. If there are any errors, please do point them out in the comments below and I will happy to correct them.

The author of this blog post is Amit Jain. He can be contacted on his Linkedin profile.

jatin grover

Posted at 10:58h, 03 MayThank you. Very good in-depth discussion. I did some research and diversified by investing in global funds but my research was similar to the way I do for Indian MF. Your post gives a different perspective to the research we should do for this category.

I will do some more research on some of the MF mentioned in your post.

Siddharth

Posted at 16:46h, 03 MayExcellent primer to global funds, A recommendation in each bucket would’ve helped.

SAMEER SOMANI

Posted at 03:40h, 04 JulyThank you for such a simple but elaborate study of Internation fund. I further request you to give us more knowledge about international index funds in India.