Decoding Jet Airways 122% rise in single day

The Jet airways surge of 122% in a single day had grabbed many eyeballs by surprise. When the debt-laden airway was in news for all the efforts to stay afloat, a sudden spike in share price posting an intraday gain of 122% was making headlines. So, was it a mixed opportunity, many investors thought? Let us look at what exactly led to this sudden spike in share price

An analysis of BSE 500 companies over the last 10 years reveal that there were ONLY three instances when a stock posted more than 50% return in a single day.

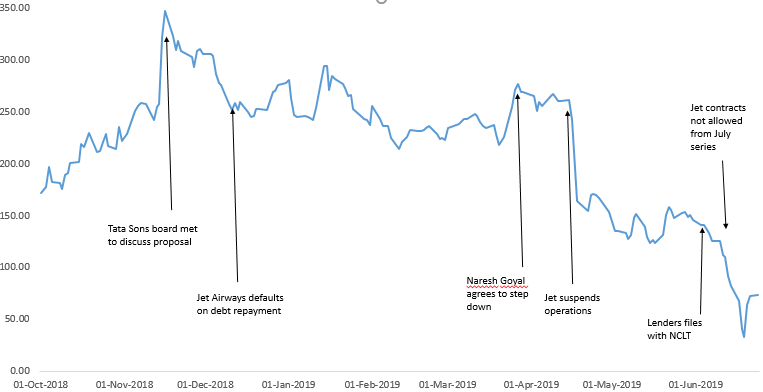

Now let us look at the events that led Jet Airways from being a valuable airline to an airline on the ventilator.

Thus a series of negative events and inability to arrange funds to continue operations led to a sharp decline in price from 280 to 63 posting, down by a whopping 78% and eroding market cap of ~ INR 2400 crs in 2019

So now a big question that arises in the minds of investor that with so many negative events surrounding the stock, how it can jump from INR 33 to INR 82 in a single day (20th June 2019).

On 20th June, 2019, the NCLT was going to announce its judgement on the plea for Jet Airways insolvency proceedings. The announcement was likely to come after market hours. As the market hours was nearing its close, sudden buying was witnessed in the stock, as most likely the buyers were expecting a positive outcome from NCLT by means of a revival plan rather than insolvency proceedings. Moreover, NSE had announced that no contracts will be allowed in futures and option segment from June expiry onwards, any fresh buying could happen in only cash segment. But this still does not explain how the stock price could have risen over 100% in a day. To understand that better, let’s look at what was happening in the futures market.

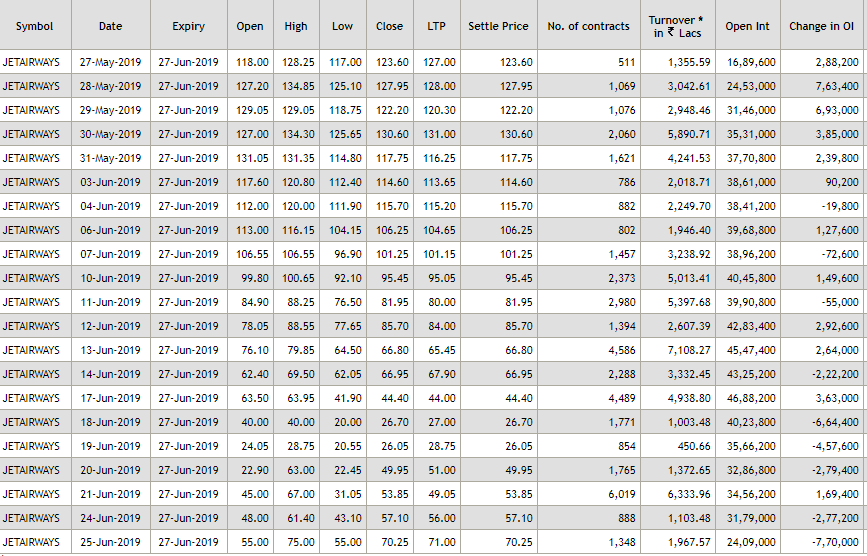

When Jet Airways share price was making new lows and loosing market cap, there were a series of players who were benefitting from the downward move viz short sellers. This are set of traders which sells the shares in the futures market with an expectation to cover their position by buying at lower price and closing their sold position. Now looking at the open interest data on NSE, open interest is the number of contracts outstanding on a given, rising open interest with a fall in price indicates that a good amount of short positions was built in the system.

Now when there is a sudden spike in share price on 20th June morning, the short sellers start making losses (notional) as now they may need to buy the shares at a higher price to close their position. So now in a rush to close their positions, they also started buying which accelerated the share price movement and thus led to skyrocketing of price in a single day. This is also a good example of a Short Squeeze, where a sudden rise in price bleeds the massive short sellers out of their positions which may lead to further fuel to the already rising price and accelerating the whole process. Below open interest data from NSE, shows a consistent fall in open interest signaling that many short sellers would have closed their short positions.

The >100% move was based on dynamics in the derivative segment and not driven by fundamental factors. In order to conclude, it is very difficult to make money from such opportunities from the investment perspective. Investors should not get influenced by such sudden price spikes and buy into it unless they are clear about the reasons behind the price action. Just to inform, post market hours when the NCLT announced its decision in favour of insolvency proceedings, the stock opened lower 10% next day and made an intraday low leading to -40%.

For long term investors, it is much better to follow a systematic investment process rather than following ‘stock tip of the day’

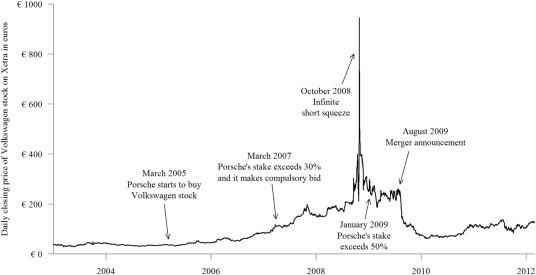

One remarkable example of Short Squeeze was when Volkswagen stock became the most valuable company in the world for a day with infinite short squeeze.

Reference:

https://www.sciencedirect.com/science/article/pii/S0927538X16300075

kamlesh

Posted at 12:25h, 03 JulyEXCELLENT KNOW HOW SHARED. LOVED IT. Caution for normal people .