Budget 2020 – Demystified

The Union Budget presented a mix higher expenditure, lower personal income tax (subject to conditions), abolition of Dividend Distribution Tax, increase in custom duties, focus on rural consumption and provided some roadmap on better private participation, in order to boost the growth which is deteriorating over the last several quarters. The expectation was quite high in the form of some big bang reforms, instead the government resorted to addressing different sections in order to boost the 3 pillars of growth : Consumption, Investment and Exports.

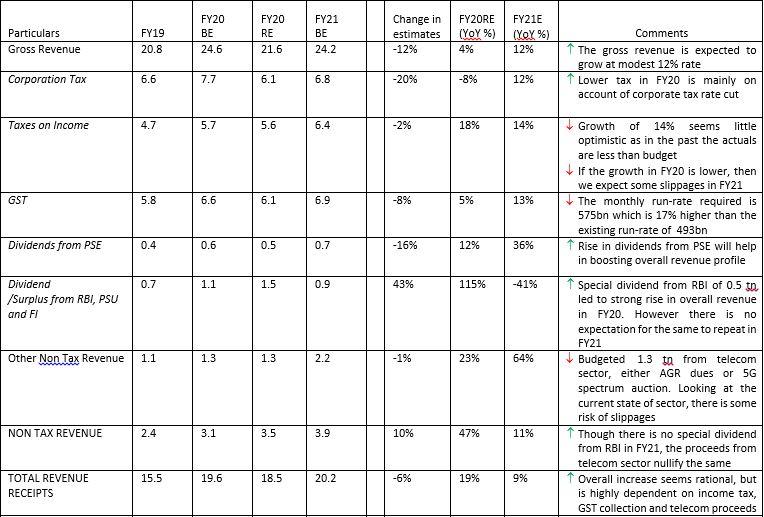

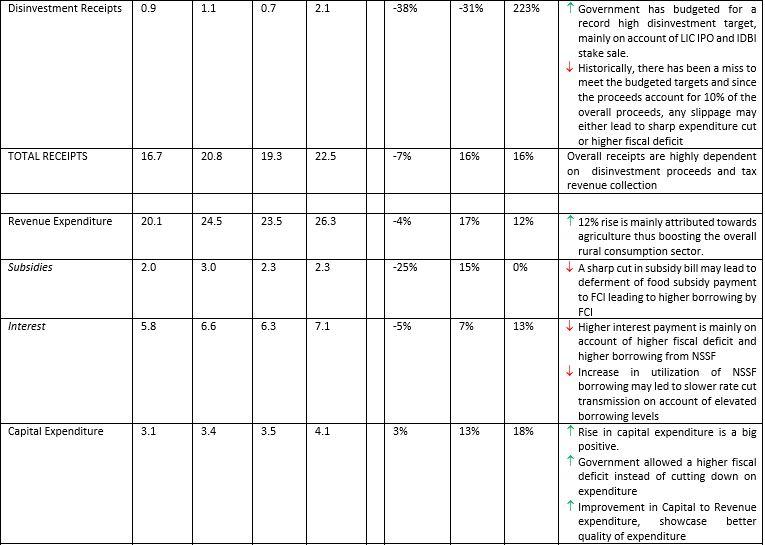

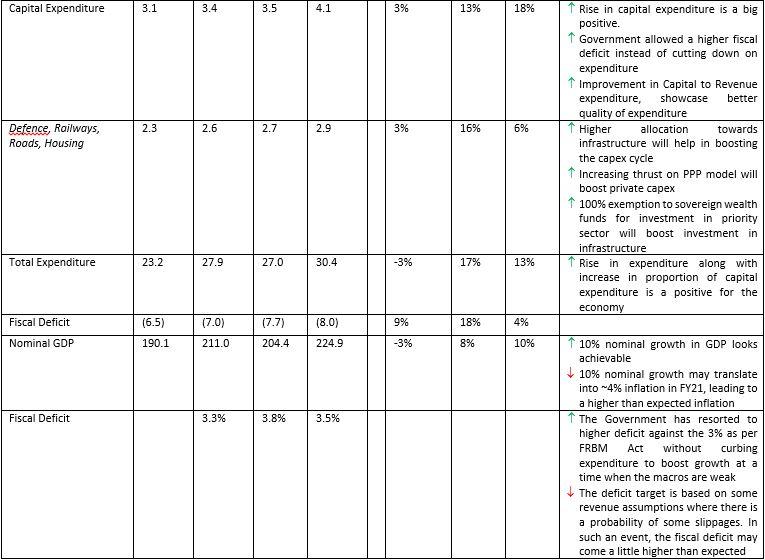

Let us understand the Budget maths along with our analysis of the various details

Below are some other highlights of the budget:

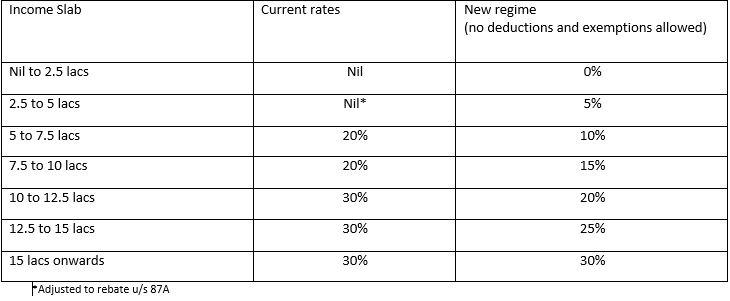

- Introduction of lower income tax regime (with exemptions and deduction)

We are not sure on the impact of this change for individual tax payers. It will be beneficial for individuals who are availing lesser exemptions, however it is in the best interest to calculate tax under both rates and then decide what is beneficial for an individual. Our bank of envelope calculation suggest, that this announcement will impact a very small segment of the tax payer universe.

- Abolition of Dividend Distribution Tax (DDT)

The tax incidence has been shifted from the companies to the individuals, who now will be liable to pay tax as per their slab rates. Currently, the effective DDT rate is ~21%. Now, the same will be taxed as per the income tax slab rate of the individual. This will be beneficial for individuals falling in lower tax bracket. Also, DDT had a nature of double taxation, now it will help with more cash reserve with the company which can be re-invested back into the business.

- Amendment in NRI criteria

Earlier in order to be classified as a NRI, a person was allowed to stay in India for 182 days or less. The same criteria have now been changed to 120 days. Thus, in order to be classified as a NRI, needs to have a stay of 120 days or less in India.

Also, an NRI, who is a part of an income-tax-free jurisdiction, is liable to pay tax on the income which arises in India.

Conclusion

Thus the reaction of the market on budget day showcased that the market was expecting some big bang reforms. There was a strong ask for either removal of LTCG or increase the period after which LTCG will become Nil, however, there was no respite on that front. With respect to budget maths, growth in income tax and all time high disinvestment targets, poses some risk to the fiscal deficit target. However, it feels that the reaction is overdone and the long term story will not be impacted by the Budget. On track collection on the tax front will provide some confidence on the revenue front along with some disinvestments that will be successfully executed. We believe the time is right to start building allocation towards mid and small-cap stocks.

On the debt front, the borrowing calendar is in line with market expectation, but higher borrowing from NSSF and higher than expected inflation in the next year, will keep the yields elevated. Thus we recommend to take exposure at the shorter end of the yield curve.

საიტების დამზადება

Posted at 00:26h, 01 MarchWow! Finally I got a website from where I know how to truly

obtain helpful data regarding my study and knowledge.